Steering Through Currency Uncertainty - How Can You Secure Your Auto Parts Export Business?

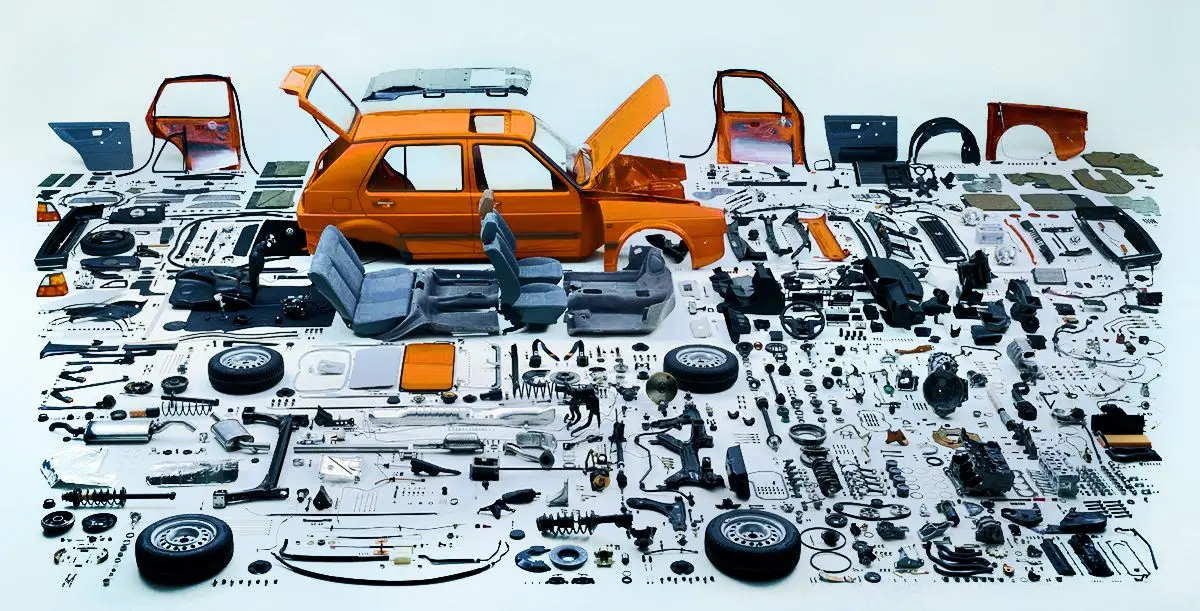

In the complicated system of international trade, Canadian companies that manufacture and sell auto parts are at a unique point where opportunities and challenges intersect. The market for automotive parts around the world is growing quickly, and Canadian exporters are well-equipped to meet this need owing to their reputation for superior workmanship and reliability. But this great potential doesn't come without obstacles. The most important one is that foreign exchange rates are hard to predict. The volatile nature of currency values can quickly turn a deal that was supposed to make money into one that loses money if it is not treated with care and foresight.

The foreign exchange market is often unstable because of many factors, such as changes in global economic data, heightened geopolitical tensions, and out of the blue global events. For companies that export car parts, this volatility can mean dealing with a constant barrage of financial uncertainty. The waves of changing exchange rates can cut into profit margins, throw off trade agreements, and even put the company's liquidity at risk.

This isn't meant to paint a bleak picture. Instead, it's to give Canadian auto parts businesses the information, strategies, and confidence they need to turn these possible risks into planned, managed, and profitable parts of their business plans. By understanding complex market trends, exploring tried-and-tested financial safeguards, and acting on the advice from industry experts, businesses can learn to not just survive the choppy waters of currency exchange, but to set full sail amidst them.

Overview of the Canadian auto parts industry

Anchoring the economy with its substantial contribution, the automotive parts industry in Canada is a cornerstone of the nation’s manufacturing sector, trade prowess, and employment statistics. In 2021 alone, the automotive sector achieved a market size of US$ 76.2 billion, with imports of parts accounting for US$ 13.1 billion and exports, an impressive US$ 11.5 billion. Beyond these figures, the industry is a vital employment source, sustaining over 125,000 jobs across various specialties.

Foreign exchange and international payment challenges for Canadian auto parts businesses

The Canadian auto parts industry is a vibrant segment of the economy, yet it grapples with complex challenges in foreign exchange and international payments. These obstacles have far-reaching impacts on profitability, operational dynamics, and strategic foresight. Let’s take a look at key issues confronting this sector:

Exchange rate volatility

The international character of the auto parts industry makes it susceptible to the whims of currency market fluctuations. Significant shifts in the value of the Canadian dollar, particularly against the benchmark US dollar, directly influence export dynamics. These oscillations can swiftly undermine profit margins or skew the global competitiveness of Canadian products, demanding constant vigilance and adaptive pricing strategies.

Transactional costs

The mechanics of international trade bring with them an assortment of ancillary charges. These range from bank-imposed fees for wire transfers to assorted transaction costs levied by intermediating parties, not to mention expenses associated with securing international credit. This financial bricolage can erode profit margins, posing a perpetual challenge for exporters seeking to maintain fiscal prudence.

Trade agreement changes

The geopolitical landscape, with its shifting allegiances and priorities, ushers in frequent recalibrations of trade agreements. Whether it’s the USMCA or pacts with EU or Asian entities, any alteration can ripple through tariff structures, bureaucratic protocols, and compliance mandates. Such flux can unsettle entrenched business frameworks and logistic networks, imposing a reevaluation of payment processes and revenue expectations.

Currency conversion and transfer delays

In the realm of high-value transactions, currency conversion is seldom instantaneous. Financial gatekeepers overseeing these conversions can introduce frustrating delays, imperiling time-bound deals. The resultant time lag not only jeopardizes favorable exchange rates but also introduces a variable risk factor that can catch exporters off guard.

Credit risk

Extending credit lines to international clientele is a gamble in trust, where Canadian exporters expose themselves to the spectrum of non-payment risks. These might stem from the buyer's financial precariousness, insolvent scenarios, or broader geopolitical upheavals that destabilize a buyer’s operational geography, making this a nuanced challenge necessitating robust risk assessment protocols.

Political and economic instability

International commerce doesn’t operate in a vacuum but is, instead, subject to the political and economic turbulence of partner nations. From sanctions and regime changes to full-blown economic crises, these disruptors can devalue currencies, compromise payment infrastructures, and, in extreme cases, lead to asset freezes or contract annulments.

Technological challenges

In an age where digital fluency is a survival skill, the evolution of financial technologies is both an opportunity and a hurdle. While new platforms promise efficiency and secure transaction avenues, they demand upfront investments and continuous upskilling. Furthermore, the digital realm is a double-edged sword, where cyber fraud risks lurk, necessitating a fortified technological defense strategy.

Partnering with MTFX for reduced currency risk exposure

MTFX is a reliable financial partner for the Canadian auto parts industry, offering a suite of features uniquely tailored to meet the demands of international trade. From superior exchange rates to strategic market insights and advanced technological platforms, MTFX empowers businesses in their global trade endeavors, fostering growth, and ensuring financial stability.

Bank-beating foreign exchange rates

In an industry where profit margins can be significantly impacted by currency exchange rates, MTFX provides a competitive edge with bank-beating rates. This ensures that businesses benefit from optimal exchange pricing, preserving their margins and enhancing competitive positioning in global markets.

Customized forward contracts

Addressing exchange rate volatility, MTFX offers the strategic advantage of customized forward contracts. By locking in exchange rates for future transactions, companies can hedge against the unpredictability of the forex market, stabilizing their financial planning and securing projected revenues.

Low-cost international transactions

MTFX offers international transactions at lower costs compared to traditional banking channels. By reducing the financial burden associated with global payments and money transfers, they enhance the cost efficiency of each transaction, directly contributing to improved profitability for exporters.

Expert navigation of economic shifts

Staying ahead of changes in international trade requires expertise and foresight. MTFX provides invaluable guidance through these complex shifts, ensuring that businesses understand the implications for their operations and are equipped with strategies to navigate disruptive economic situations.

Efficient currency conversion and transfer services

Delays in currency conversion and fund transfers can disrupt cash flows and timely payments. MTFX addresses this with efficient, streamlined services, significantly reducing the waiting period for conversions and transfers. The promptness ensures businesses can operate without disruptive financial lags, maintaining smooth business relations with overseas partners.

Robust credit risk management

Engaging in international trade entails exposure to credit risks. MTFX's robust risk management services help companies vet the creditworthiness of international partners, safeguarding against potential default scenarios. This proactive approach is crucial in maintaining the financial integrity and cash flow necessary for sustained business operations.

Real-time market insights and stability strategies

With geopolitical and economic conditions often influencing market stability, MTFX's real-time insights become a critical asset. They offer businesses regular updates on situations that may affect currency values and international trading conditions, coupled with strategies to shield against market instabilities.

Advanced secure financial technology

The adoption of cutting-edge financial technology is at the heart of MTFX services. By utilizing advanced platforms, we ensure transaction processes are not only swift but also secure. This commitment to technology optimizes operational efficiencies and protects client financial data from cyber threats, a growing concern in digital transaction space.

Final word

Canadian companies that make and sell car parts don't have to figure out the complicated world of international trade and foreign exchange on their own. Businesses get a reliable partner in MTFX's customized financial services helping them keep a strong global footprint by making sure they get the best foreign exchange rates. With MTFX, businesses are better equipped to drive forward with confidence, making the most of every opportunity that comes their way on the global stage.

Open an account today and get bank-beating foreign exchange rates, low transfer fees, and quick, secure international money transfers for your business.

Popular related articles:

Copyright © 2024 MTFX Group