Weekly Currency Update: Canadian Dollar Forecast This Week

Gain clarity with the Canadian dollar forecast this week, including insights into the foreign exchange market and the impact of exchange rate fluctuations, as part of your weekly currency update. Backed by in-depth market research, economic data, and expert commentary, our analysis equips individuals and businesses with the insights they need to manage currency risk, stay updated on market trends, seize timely opportunities, and maximize the value when sending money abroad.

Weekly Currency Performance Table

Currency | Closing | Weekly | Monthly | Yearly |

|---|---|---|---|---|

| USD / CAD | 1.37 | 0.47% | -0.75% | -3.78% |

| CAD / CHF | 0.57 | 0.60% | -0.91% | -10.14% |

| EUR / CAD | 1.61 | -0.27% | -0.54% | 8.39% |

| AUD / CAD | 0.97 | 0.58% | 2.76% | 7.24% |

| CAD / JPY | 113.35 | 1.08% | -1.36% | 8.00% |

| GBP / CAD | 1.84 | -0.75% | -0.88% | 2.72% |

| NZD / CAD | 0.82 | -0.57% | 0.07% | 0.20% |

| CAD / CNY | 5.05 | -0.46% | -0.17% | -0.92% |

| CAD / INR | 66.31 | -0.27% | -0.16% | 8.97% |

| CAD / MXN | 12.52 | -0.60% | -1.18% | -12.69% |

| FX Market This Week | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

USD | The US dollar staged a modest recovery during the week of February 16–20, with the Dollar Index (DXY) climbing from the mid-96s to briefly test the 98.00 area before easing slightly into Friday. Mid-week gains were underpinned by a combination of geopolitical tensions, resilient US macro data including firmer housing and production figures, and lingering inflation concerns that reinforced safe-haven demand and steady Federal Reserve expectations. However, the rally lost some momentum at week’s end after the US Supreme Court struck down former President Trump’s tariffs, triggering a surge in equities and softening defensive dollar flows as investors reassessed policy and fiscal implications. While sentiment among fund managers remains broadly bearish on the dollar longer term, near-term direction will hinge on incoming data, alongside shifts in global risk appetite and geopolitical developments. | |||||||||

CAD | The Canadian dollar edged modestly lower against the USD over the latest trading stretch, as broader greenback strength and cautious global sentiment limited upside momentum for the loonie. While domestic fundamentals remained relatively steady, with the exception of softening inflation, and oil prices were broadly stable, the absence of a stronger crude rally reduced a key source of support for CAD. Mid-period US data resilience and geopolitical undercurrents reinforced demand for the dollar, weighing on CAD performance. A shift in market sentiment following the US Supreme Court’s tariff ruling also contributed to cross-asset repositioning that offered little sustained relief for the loonie. Although futures positioning suggested growing constructive interest in the Canadian dollar, spot action reflected only mild softness. Going forward, CAD direction will depend on incoming economic data, energy price dynamics and the broader trajectory of US macro conditions. Expected weekly trading range: 1.35 - 1.39 | |||||||||

EUR | The euro drifted modestly lower over the latest trading stretch, with EUR/USD moving within a relatively tight range before ending slightly softer overall. Early attempts to stabilize were overshadowed mid-period by renewed USD strength, as firmer American macro signals and geopolitical undertones supported the greenback. At the same time, commentary from ECB officials pointing to renewed disinflationary pressures and cautious policy expectations tempered enthusiasm for the single currency. Although risk sentiment improved toward the end of the week following the US Supreme Court’s tariff decision, the dollar’s pullback was limited, preventing a stronger euro rebound. Positioning dynamics near recent highs also contributed to the pair’s inability to sustain upside momentum. Looking ahead, the euro’s trajectory will hinge on incoming euro area inflation data, ECB guidance, and the global risk appetite. Expected weekly trading range: 1.59 - 1.63 | |||||||||

GBP | The British pound softened notably against the major currencies over the week, with sterling trending lower as markets increasingly priced in a more dovish BoE outlook. Weaker labour market signals, easing wage pressures and softer inflation data reinforced expectations of near-term rate cuts, weighing on GBP sentiment despite pockets of resilience in retail sales and select fiscal indicators. The broader macro mix left investors cautious, limiting appetite to rebuild long sterling positions. At the same time, renewed mid-week strength in the USD amplified downside pressure on GBP, pushing it toward multi-week lows. Looking ahead, sterling’s direction will depend heavily on incoming UK data, as well as further guidance from the Bank of England, while shifts in US economic momentum and Federal Reserve expectations will remain key external drivers. Expected weekly trading range: 1.81 - 1.87 | |||||||||

JPY | The Japanese yen softened this week, with USD/JPY grinding higher as renewed dollar demand and shifting global sentiment weighed on the currency. After a strong rally in the prior period, the yen faced profit-taking flows, limiting its ability to extend gains. Broader US dollar resilience, supported by firm macro signals, further pressured the pair higher. Meanwhile, the Bank of Japan’s policy stance remained widely viewed as steady and accommodative, offering little catalyst for renewed yen strength in the near term. In a backdrop where risk appetite improved at times, traditional safe-haven demand for the yen was subdued. Looking ahead, direction will hinge on Bank of Japan communication, US data and Federal Reserve expectations, as well as any shifts in global risk dynamics that could revive defensive flows into the currency. Expected weekly trading range: 111.65 - 115.05 | |||||||||

CHF | The Swiss franc lost modest ground as the US dollar firmed through the period, with USD/CHF gradually pushing higher. Demand for the greenback, supported by steady US macro signals and positioning flows, outweighed the franc’s traditional safe-haven appeal. Although global risk conditions were mixed, they failed to generate sustained defensive inflows into CHF, leaving it vulnerable to broader dollar momentum. The move also unfolded against a backdrop of an already-strong franc in recent months, which helped keep volatility contained rather than triggering a sharper reversal. With no fresh policy signals from the Swiss National Bank, markets remained focused on external drivers, particularly US data and Federal Reserve expectations. Going forward, shifts in global risk appetite and any SNB commentary on currency strength will be key for franc direction. Expected weekly trading range: 0.56 - 0.58 | |||||||||

CNY | The Chinese yuan held broadly steady with a slight firming bias, as USD/CNY remained confined to a narrow range and drifted marginally lower overall. Currency volatility was subdued, reflecting balanced dollar movements and continued guidance from the People’s Bank of China through its daily fixing. Supportive regional positioning and constructive sentiment toward emerging Asian currencies helped underpin the renminbi, while seasonal corporate FX flows, including exporter conversions, added a layer of underlying demand. With the dollar index relatively stable during the period, external pressures on the yuan were limited, resulting in contained price action. Looking ahead, attention will centre on PBOC policy signals, trade and capital flow trends, and the broader trajectory of US macro data and Federal Reserve expectations. Expected weekly trading range: 4.97 - 5.13 | |||||||||

INR | The Indian rupee slipped modestly as steady dollar demand and external pressures nudged USD/INR higher within a contained range. Early weakness was driven by foreign fund outflows and importer demand for dollars, while activity in non-deliverable forward markets reinforced upward pressure on the pair. At the same time, likely intervention signals from the Reserve Bank of India helped prevent sharper depreciation near key psychological levels, keeping moves orderly. Elevated crude oil prices amid renewed geopolitical tensions added another layer of strain, given India’s heavy reliance on energy imports. Overall, the rupee maintained a relatively narrow trading band but with a mild weakening bias. Looking ahead, direction will depend on US inflation trends and Federal Reserve expectations, RBI policy cues and reserve management, oil price dynamics and the trajectory of portfolio flows into Indian assets. Expected weekly trading range: 65.32 - 67.31 | |||||||||

AUD | The Australian dollar edged modestly lower as firmer USD momentum trimmed earlier resilience in AUD/USD. The pair traded within a relatively tight band, with supportive commodity prices and steady domestic fundamentals helping anchor the currency near the 0.70 handle, even as broader greenback demand capped upside attempts. Risk sentiment remained an important driver, with equity strength and gains in the ASX 200 offering intermittent support, though not enough to offset renewed dollar traction into the close. Interest rate differentials and increased hedging activity from large Australian institutional investors also featured in the backdrop, reinforcing a view that the currency retains medium-term underpinning despite short-term softness. Looking ahead, direction will hinge on Reserve Bank of Australia guidance, US macro data and Federal Reserve expectations, alongside global risk appetite and incoming signals from China’s economic outlook. Expected weekly trading range: 0.96 - 0.98 | |||||||||

NZD | The New Zealand dollar gave up modest ground as renewed USD demand and uneven risk sentiment nudged NZD/USD lower within a contained range. While the kiwi showed early stability, firmer greenback momentum mid-to-late period limited upside attempts and gradually pressured the pair toward the lower end of its recent band. The absence of major domestic economic surprises or fresh guidance from the Reserve Bank of New Zealand left the currency largely reactive to external drivers rather than home-grown catalysts. As a risk-sensitive unit, the NZD also felt the impact of patchy global sentiment, with softer risk appetite tending to favour the dollar. Cross-currency performance remained relatively stable, reinforcing the view that broader FX flows dominated price action. Looking ahead, attention will turn to RBNZ communication, US macro developments and Federal Reserve expectations, as well as shifts in global risk dynamics and China-linked demand signals. Expected weekly trading range: 0.81 - 0.83 | |||||||||

MXN | The Mexican peso posted a modest advance as USD/MXN edged lower, supported by a softer tone in the US dollar and steady emerging-market inflows. Carry appeal remained a key pillar for the currency, with Mexico’s yield backdrop continuing to attract interest amid relatively stable risk conditions. Domestic fundamentals, including firm inflation dynamics and a steady policy stance from Banco de México, reinforced confidence in the peso’s resilience. Supportive commodity prices, particularly in energy markets, also helped underpin sentiment given Mexico’s export profile. While intermittent bouts of cautious risk appetite trimmed some gains, the overall bias favoured MXN strength. Looking ahead, the peso’s direction will depend on US macro momentum and Federal Reserve expectations, central bank guidance from Banxico, oil price trends and broader emerging-market capital flows. Expected weekly trading range: 12.33 - 12.71 | |||||||||

Key Economic Indicators Impacting the Loonie

Economic calendar events for the week starting February 23 are heavily US-focused, suggesting USD/CAD will remain particularly sensitive to American growth and labour signals before shifting toward key Canadian releases at week’s end. Early-week data such as Factory Orders, regional manufacturing indices and Consumer Confidence will help gauge underlying US economic momentum. If US activity indicators remain firm and PPI shows sticky price pressures, markets may reassess the pace of Fed easing expectations, potentially supporting the US dollar and pushing USD/CAD higher. Meanwhile, ADP employment and jobless claims will act as short-term volatility triggers, especially if they signal renewed labour market strength.

Mid-to-late week, attention broadens as Eurozone inflation and sentiment data influence broader risk appetite, but the real turning point for USD/CAD comes Friday with Canadian GDP and Budget Balance figures. A stronger-than-expected Canadian growth print could revive confidence in the domestic outlook and provide support to the loonie, particularly if US data softens into the end of the week. Conversely, weak Canadian GDP combined with firm US producer prices or resilient Chicago PMI could widen rate differentials in favour of the greenback. Overall, USD/CAD may remain range-bound early in the week before seeing sharper directional moves as Canadian macro data resets expectations for the Bank of Canada’s policy trajectory.

| Key Economic Data Events This Week | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD | Feb 23, 2026 | Factory Orders | |||||||||||||||||

| USD | Feb 23, 2026 | Dallas Fed Manufacturing Index | |||||||||||||||||

| USD | Feb 24, 2026 | ADP Employment Change Weekly | |||||||||||||||||

| USD | Feb 24, 2026 | House Price Index | |||||||||||||||||

| USD | Feb 24, 2026 | Consumer Confidence | |||||||||||||||||

| USD | Feb 24, 2026 | Richmond Manufacturing Index | |||||||||||||||||

| USD | Feb 24, 2026 | Wholesale Inventories | |||||||||||||||||

| EUR | Feb 25, 2026 | Inflation Rate | |||||||||||||||||

| CAD | Feb 25, 2026 | Manufacturing Sales | |||||||||||||||||

| USD | Feb 24, 2026 | Fed Balance Sheet | |||||||||||||||||

| EUR | Feb 26, 2026 | Economic Sentiment | |||||||||||||||||

| USD | Feb 26, 2026 | Initial Jobless Claims | |||||||||||||||||

| CAD | Feb 26, 2026 | Current Account | |||||||||||||||||

| CAD | Feb 26, 2026 | Average Weekly Earnings | |||||||||||||||||

| GBP | Feb 26, 2026 | Consumer Confidence | |||||||||||||||||

| GBP | Feb 26, 2026 | Nationwide House Prices | |||||||||||||||||

| USD | Feb 27, 2026 | Producer Prices Index | |||||||||||||||||

| CAD | Feb 27, 2026 | GDP Growth Rate | |||||||||||||||||

| USD | Feb 27, 2026 | Chicago PMI | |||||||||||||||||

| CAD | Feb 27, 2026 | Budget Balance | |||||||||||||||||

Currency market updates

Track key currency movements and plan your transfers with confidence.

Switch to MTFX for better exchange rates, lower fees, and real savings on foreign currency transfers.

We make sending money simple

How to send money with MTFX

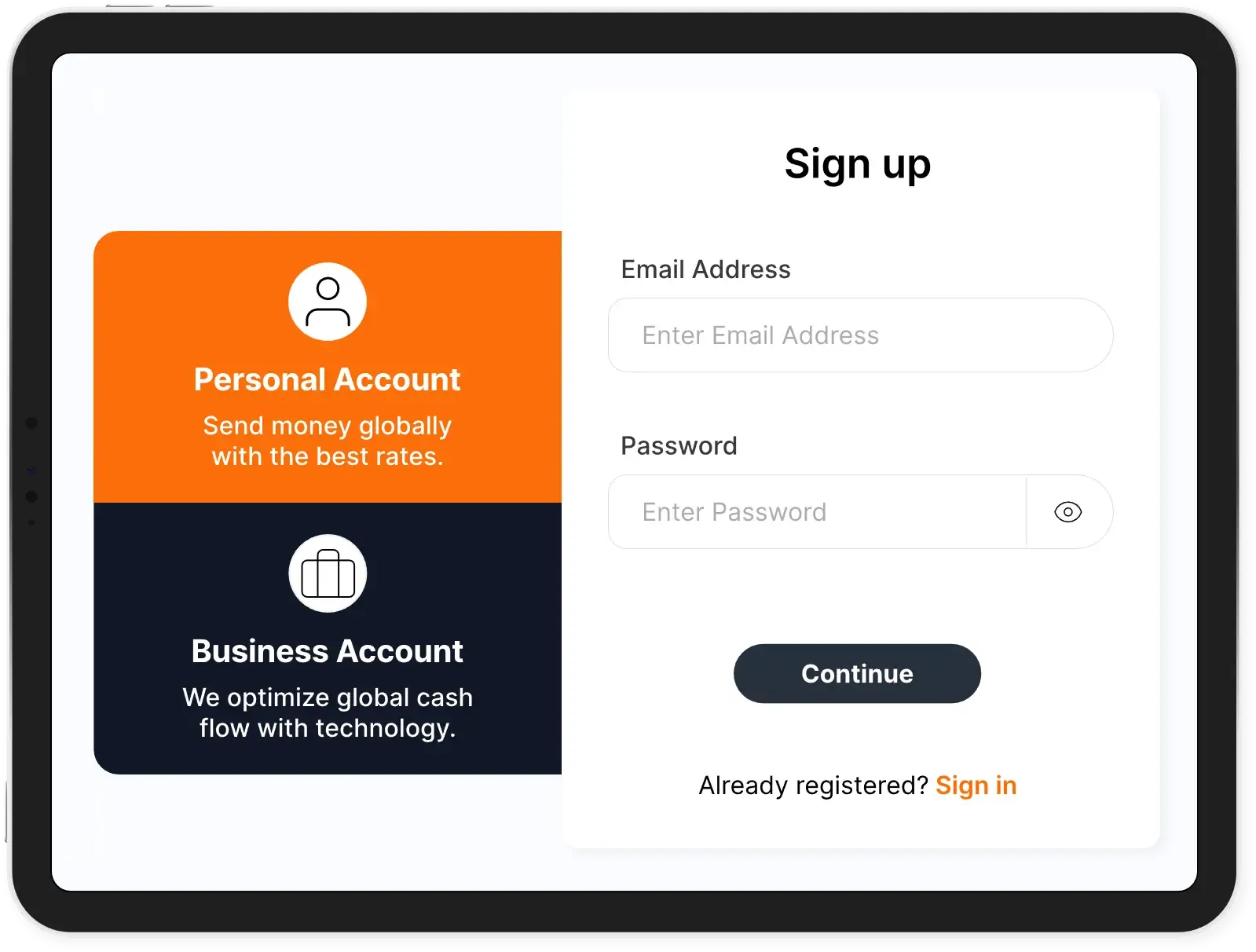

Open your personal or business account and start saving on international money transfers.

- 1Sign up for free

Create your account in less than five minutes—no setup fees or hidden charges.

- 2Get a real-time exchange rate

Instantly access competitive exchange rates for your transfer amount and destination.

- 3Enter recipient information

Provide your recipient’s banking details to ensure fast and secure delivery of funds.

- 4Confirm and send your transfer

Review the details, complete your transaction, and track your transfer every step of the way.

How we deliver reliable weekly FX insights?

MTFX’s weekly FX analysis is built on a foundation of data-driven research and decades of market experience. Each report draws from a combination of live exchange rate feeds, central bank publications, economic calendars, and insights from top financial institutions. Our analysts interpret these inputs to provide clear, actionable commentary.

We focus on transparency and consistency, so you always know where the information comes from and why it matters. Whether you're tracking USD/CAD or broader market shifts, MTFX offers reliable weekly FX updates you can use to plan smarter currency transfers and protect your bottom line.

How we deliver reliable weekly FX insights?

MTFX’s weekly FX analysis is built on a foundation of data-driven research and decades of market experience. Each report draws from a combination of live exchange rate feeds, central bank publications, economic calendars, and insights from top financial institutions. Our analysts interpret these inputs to provide clear, actionable commentary.

We focus on transparency and consistency, so you always know where the information comes from and why it matters. Whether you're tracking USD/CAD or broader market shifts, MTFX offers reliable weekly FX updates you can use to plan smarter currency transfers and protect your bottom line.

What can cause fluctuations in weekly exchange rates?

Weekly exchange rates can shift due to a range of economic and geopolitical factors. Central bank interest rate decisions, inflation reports, employment data, and political developments all play a role in driving currency values.

For example, if oil prices surge or the Bank of Canada issues a surprise policy change, it could significantly impact the Canadian dollar this week. Since FX markets are highly reactive, rates can change multiple times throughout the week. While our FX weekly outlook provides expert insights and trends, contact MTFX directly for real-time, bank-beating exchange rates tailored to your needs.

With MTFX, you can send money to over 190 countries in 50+ currencies—quickly, securely and at competitive rates.