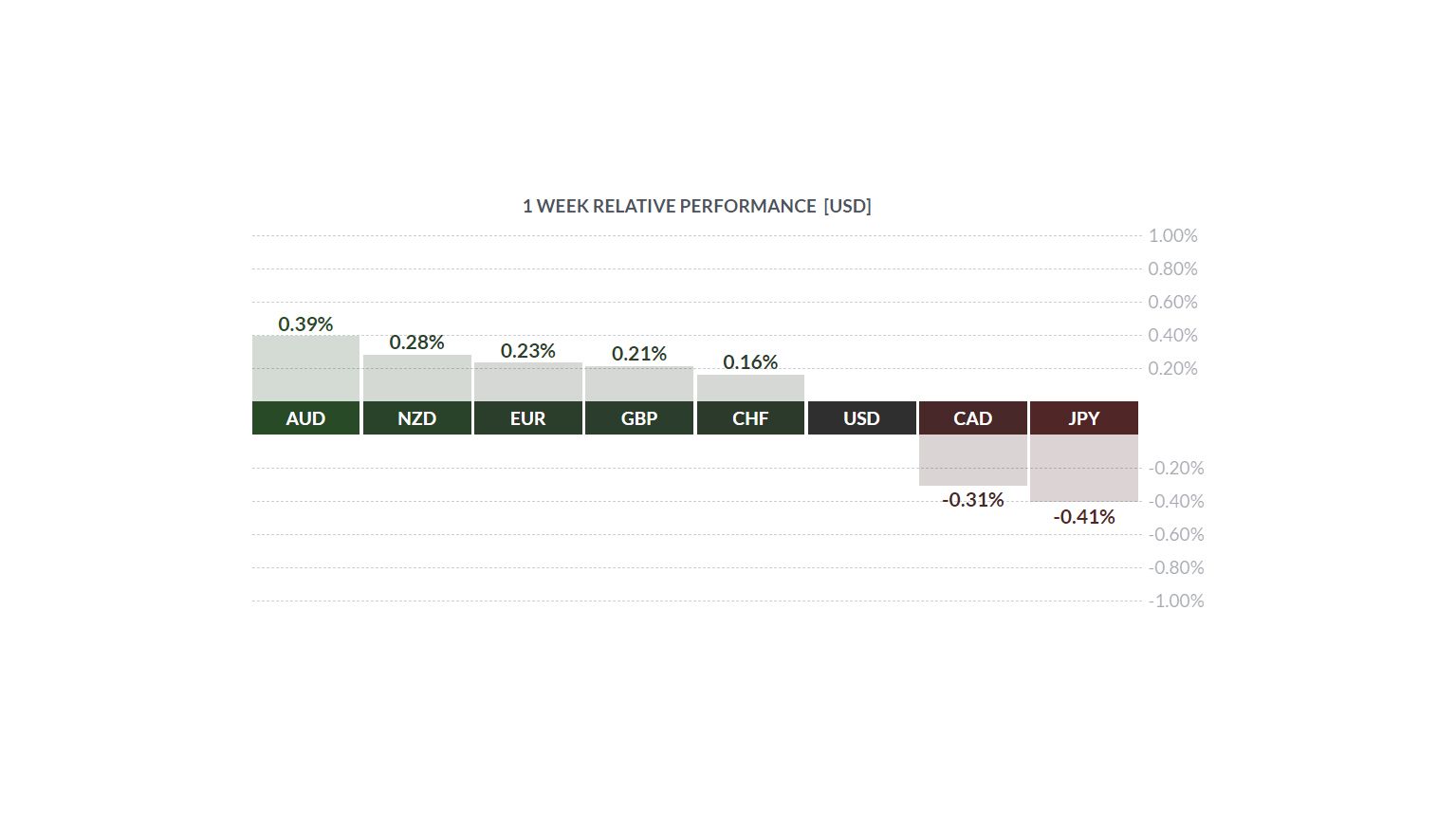

The Worst Five-Day Performance Among the Major Currencies

- The CAD underperformed once more last week and has had the worst five-day performance among the major currencies. In contrast to a generally weak USD, the CAD fell by about 0.7% during the past week. CAD weakness on the key crosses has increased as the JPY has increased by 2.8%, the GBP by 0.9%, and the EUR by 0.8%. In the upcoming months, this theme is likely going to continue. In the first nine months of this year, the CAD underperformed its major currency peers but gained ground versus a generally stronger USD. We anticipate that the CAD will continue to struggle against the USD and reverse against the majority of the gains made earlier as the broader USD bull trend moderates and shows signs of a deeper reversal. The push and pull of the crosses and USD trends likely mean a wide and choppy range trade for USD/CAD will persist through the early part of 2023 at least.

CAD Remains Slightly Undervalued

- Technical analysis shows that the CAD is slightly undervalued. The USD is trading substantially over 1.34, compared to an estimated equilibrium of 1.3317, due to post-NFP data volatility. Unsurprisingly, the week ahead component of the model implies that spot has a small amount of potential downside during the upcoming week. The implied range of 1.3285 to 1.3610 accurately depicts the possible trading range for spot. Although correlations are typically improving, the risk environment continues to have a significant impact on the performance of the CAD via correlations with the S&P 500.

Bank of Canada’s Policy Announcement

- This week's scant Canadian data is not expected to have much of an impact on market sentiment either before or after the Bank of Canada's policy announcement on Wednesday. The consensus projection reflects experts' evenly divided opinions on whether the Bank will raise rates by 25 basis points or by 50 basis points (12 responses per side in the Bloomberg survey). Given the strong economic growth, persistently high inflation, and heightened inflation expectations, a prudent call would be for an increase of 50 basis points to bring the overnight rate to 4.25%, where we anticipate the bank to rest for the upcoming few months. The slowdown in the domestic housing market and concerns about high household mortgage debt could argue for a more moderate hike but there are clear doubts about whether the bank has sufficient evidence to downshift on hikes again. Pricing has firmed up following today’s Canadian jobs employment report which showed on expectations jobs growth but still elevated wages and a lower unemployment rate.

This Week’s Technical Range

- Key support next week remains at 1.3380/90 ahead of 1.3215 while resistance is 1.3545/50 and (strong at) 1.3615.

Let us watch the market for you

Currency market are always moving. Set an alert so you never miss your desired.

Sign up to receive the latest market news from our experts.

FAQs

Who can use the MTFX payment service?

Why should I use MTFX and not my own bank?

How do customers send funds to MTFX?

How long does it take MTFX to transfer funds?

Copyright © 2024 MTFX Group