Send Money to Pay Overseas Suppliers from Canada

Many Canadian businesses are looking further afield and sourcing products from overseas suppliers. How can they reduce costs when making international payments?

The global marketplace is rapidly expanding, and innovative Canadian businesses are carving out a piece of the pie for themselves. If your business already has suppliers based overseas, it’s high time you considered the cost of doing business internationally and what you can do to save more money.

When you begin sending money transfers to your overseas suppliers, banks might seem like the most convenient option. Yet, there are better opportunities to tap into more flexible and cost-effective business money exchange services. So, if you’re looking to pay overseas suppliers on the regular, here’s what you need to know.

Sending money overseas? Here’s why banks are not the best option

Sending money overseas to suppliers can be convenient and fast with minimal impact on the value of your international transfer — but only if you choose the right provider. Thus, the question is, “Should you use your bank to pay your across-the-border suppliers?” Here’s a checklist that shows why banks are not the ideal candidate.

- Cost – Banks don’t offer specialized money transfer services, so the exchange rate you get is rarely the best on the market. You also have to shell out extra to cover banking fees.

- Speed – Deadlines can make or break a good deal, but it’s challenging to come out on top with costly delays and waiting times of 4-6 days (the norm for most banks).

- Accessibility – You can usually only make international money transfers during office hours when using a bank. If you want to improve business agility, it’s better to look for options that offer 24/7 online access.

- Convenience – Since most banks don’t provide specialized money transfer services, you’re missing out on automated technologies and foreign exchange tools that streamline your outgoing payments.

- Regular transfers – Repeat money transfers can be costly when using banks, given the not-so-competitive exchange rates and high fees.

- Customer service – You might be hard-pressed to find foreign exchange specialists at banks that help create a more personalized experience.

The best way to send money overseas

It may be necessary to consider various currency pairs when your suppliers are scattered across the globe. For example, let’s say you have an upcoming payment due to a European supplier. You need to carefully consider the Canadian dollar to euro exchange rate before you transfer money to a foreign bank account. With a US supplier, the USD/CAD comes into play.

To avoid this, you need to ask the right questions, including the following:

- What’s the exchange rate right now? – Stay current with MTFX’s live rate calculator.

- What is a good exchange rate? – Check currency charts to get the bigger picture.

- Is it a good time to pay my suppliers? – Get rate alerts to keep you in the loop.

- How can I protect my business from fluctuating exchange rates? – Consider forward contracts and market orders to lock in favorable rates.

Being smart about exchange rates and using the right foreign exchange tools can potentially save you thousands of dollars and boost your bottom line by more than a blip.

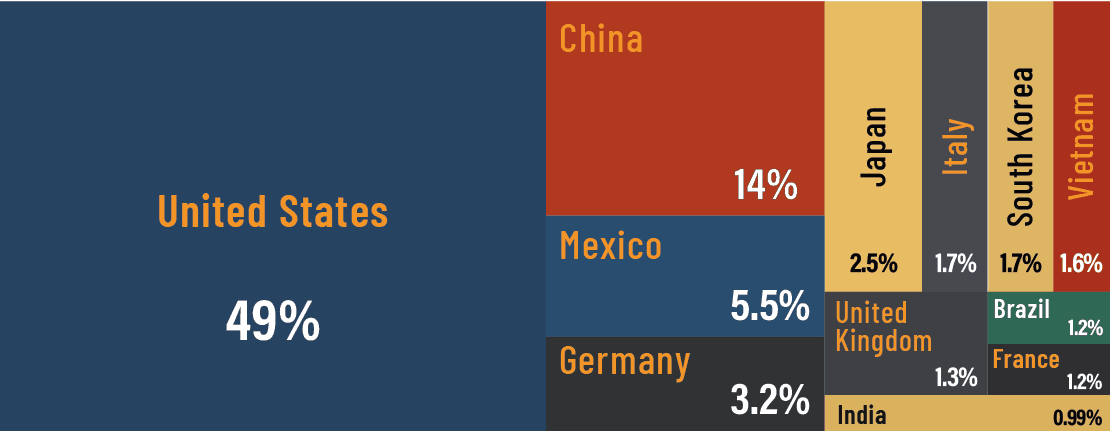

Top Canada imports and trading partners

Data credits tradingeconomics

Data credits tradingeconomics

Canadian businesses have a whole host of options to choose from when sourcing products from overseas suppliers. Canada’s top imports include:

- Cars, car parts, and accessories

- Trucks

- Crude oil and processed petroleum oil

- Computers and phones

- Medications

- Precious minerals

These imports all run into the billions of dollars. Canada’s trading partners by imports for 2021 include the following from top to bottom:

- United States

- China

- Mexico

- Germany

- Japan

- Italy

There are several benefits to Canadian businesses of sourcing products from international brands. The list includes improved innovation, a sharper competitive edge, and a better cost-quality balance.

Prioritizing competitive exchange rates and low fees when paying suppliers can enhance these benefits.

What information do I need to send money to pay for overseas suppliers?

Make sure you have the following information on hand when sending money to pay for overseas suppliers:

- Beneficiary name

- Beneficiary account number

- Beneficiary address

- Bank name

- Bank Swift code

- Bank address

- Reason for transfer

Can I set up regular payments to pay my overseas suppliers?

Yes. The first step is registering an MTFX business account in under a few minutes. With your account, you can easily automate your payment and send transfers in 50+ different currencies to 200+ different countries. MTFX’s 24/7 online platform offers industry-leading automation technologies that eliminate manual errors while improving the efficiency and security of your transfers.

Why MTFX?

MTFX offers several benefits for your business:

- Exchange rates are 3-5% lower than banks (send 30,000, save up to 1,500)

- Competitive transaction fees

- A variety of payment options

- Secure, multi-currency account to streamline payments to overseas suppliers

- Efficient services and fast turnaround times of 1-2 days

- Combination of foreign exchange tools and specialists for a better transfer experience

- And more

These are all the reasons you need to register your MTFX business account today. Start saving money with your first transfer, today.

Popular related articles;

- How to Invoice International clients - Cheaper, Faster and Easier

- 5 Important Steps in the Overseas Payment Process

- How to reduce costs when doing business internationally?

- Send Money to Pay Suppliers in China

- Are you an Importer or Exporter? A Forward Contract could Add Certainty in Uncertain Times

- The Vaccine is here. Now What? Are fintech’s ‘The New Normal’?

Related Blogs

Stay ahead with fresh perspectives, expert tips, and inspiring stories.

Keep updated

Make informed decisions

Access tools to help you track, manage, and simplify your global payments.

Currency market updates

Track key currency movements and plan your transfers with confidence.

Create an account today

Start today, and let us take the hassle out of overseas transfers.