Weekly Currency Update: Canadian Dollar Forecast This Week

Gain clarity with the Canadian dollar forecast this week, including insights into the foreign exchange market and the impact of exchange rate fluctuations, as part of your weekly currency update. Backed by in-depth market research, economic data, and expert commentary, our analysis equips individuals and businesses with the insights they need to manage currency risk, stay updated on market trends, seize timely opportunities, and maximize the value when sending money abroad.

Weekly Currency Performance Table

Currency | Closing | Weekly | Monthly | Yearly |

|---|---|---|---|---|

| USD / CAD | 1.36 | -0.23% | 0.17% | -5.62% |

| CAD / CHF | 0.57 | -0.05% | -0.49% | -8.67% |

| EUR / CAD | 1.64 | -0.84% | -0.72% | 5.43% |

| AUD / CAD | 0.97 | -0.26% | 0.62% | 6.97% |

| CAD / JPY | 114.36 | 1.86% | 0.74% | 11.43% |

| GBP / CAD | 1.84 | -1.26% | -2.35% | -0.76% |

| NZD / CAD | 0.82 | -0.51% | -1.59% | -0.15% |

| CAD / CNY | 5.03 | -0.50% | -1.32% | -0.20% |

| CAD / INR | 66.75 | 0.80% | 1.05% | 11.18% |

| CAD / MXN | 12.63 | 0.74% | 0.55% | -11.05% |

| FX Market This Week | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

USD | The US dollar consolidated near recent highs, with the Dollar Index trading in a tight band and finishing marginally softer overall while remaining well supported. Safe-haven demand linked to escalating Middle East tensions underpinned the greenback, particularly alongside firm US Treasury flows. At the same time, a hotter-than-expected Producer Price Index reinforced the view that the Federal Reserve is unlikely to rush into rate cuts, helping anchor the dollar despite limited upside momentum. Ongoing tariff debates and fiscal uncertainty tempered conviction, keeping positioning cautious and price action largely range-bound. Overall, the dollar held resilient levels even as it drifted slightly lower into the close. Looking ahead, focus will shift to US inflation and payroll data, Federal Reserve commentary, and geopolitical developments, all of which remain central to near-term dollar direction. | |||||||||

CAD | The Canadian dollar regained traction through the period, reversing early softness and pushing USD/CAD lower by the close as external drivers turned more supportive. Initial caution linked to US trade policy uncertainty kept the loonie on the defensive, but sentiment improved as the broader US dollar eased and commodity markets strengthened. Notably, a rally in oil prices provided a meaningful tailwind for the resource-linked currency, reinforcing demand despite an unexpected contraction in Canada’s fourth-quarter GDP. Markets largely downplayed the weak domestic growth print, choosing instead to focus on shifting global flows and relative dollar dynamics. Positioning trends, which had leaned constructively toward CAD earlier in the month, also helped amplify late-week gains. In the sessions ahead, attention will centre on Canadian inflation and labour data, oil price momentum, US macro developments and evolving trade policy signals, all of which remain pivotal for the loonie’s near-term direction. Expected weekly trading range: 1.34 - 1.38 | |||||||||

EUR | The euro moved through a period of consolidation, with EUR/USD confined to a tight band and ending the week little changed overall. Price action reflected a lack of conviction on both sides of the pair, as investors balanced steady US fundamentals against an absence of fresh euro area catalysts. Geopolitical tensions, particularly in the Middle East, intermittently supported safe-haven demand for the dollar, limiting upside attempts in the single currency. At the same time, muted communication from the European Central Bank left rate expectations largely unchanged, offering no decisive push for euro bulls. The result was choppy, range-bound trading centred around the high-1.17 to low-1.18 zone. Looking ahead, direction will hinge on incoming US inflation and activity data, ECB guidance and shifts in global risk sentiment, all of which could determine whether the euro breaks out of its recent consolidation phase. Expected weekly trading range: 1.61 - 1.66 | |||||||||

GBP | Sterling navigated a narrow corridor through the week, with GBP/USD oscillating around the mid-1.34s and closing little changed overall, though with a slightly softer tone. Political uncertainty in the UK, including surprise by-election developments that raised fresh questions about leadership stability, injected a modest risk premium into the currency and capped upside attempts. At the same time, markets continued to lean toward a more accommodative Bank of England outlook, with easing expectations limiting demand for the pound relative to the US dollar. Late-week firming in the greenback, supported by risk-off flows and resilient US data, further restrained gains. Technically, repeated failures to sustain moves above key psychological levels reinforced the range-bound pattern. In the sessions ahead, attention will centre on Bank of England guidance, UK political headlines and incoming US macro data, all of which remain critical for sterling’s directional bias. Expected weekly trading range: 1.81 - 1.87 | |||||||||

JPY | The Japanese yen retreated over the period, with USD/JPY advancing into the mid-150s as policy divergence and dollar demand weighed on the currency. Market reaction to the appointment of two dovish Bank of Japan board members reinforced expectations that ultra-loose monetary settings will remain in place, dampening prospects for near-term tightening and limiting support for the yen. At the same time, resilient US data and ongoing geopolitical tensions channelled flows toward the dollar, further pressuring JPY despite its traditional safe-haven status. Intervention chatter and rate-check speculation underscored official sensitivity to rapid moves, though no decisive action materialised. In the near term, yen direction will hinge on evolving Bank of Japan guidance, US macro momentum and global risk sentiment, particularly across key crosses such as EUR/JPY and AUD/JPY that often reflect broader appetite trends. Expected weekly trading range: 112.64 - 116.08 | |||||||||

CHF | The Swiss franc drifted lower as USD/CHF advanced steadily, reflecting stronger demand for the greenback amid heightened geopolitical tensions and firm US macro signals. Although the franc retains its safe-haven credentials, defensive flows favoured the US dollar more decisively during this stretch, limiting CHF outperformance. With no fresh guidance from the Swiss National Bank, the currency lacked a domestic catalyst and remained largely driven by external forces, particularly shifting Federal Reserve expectations and broader risk dynamics. Cross-currency performance was relatively contained, underscoring that the move was primarily dollar-led rather than CHF-specific weakness. In the days ahead, focus will turn to US economic releases, geopolitical developments and any commentary from the SNB that could influence sentiment toward the franc. Expected weekly trading range: 0.56 - 0.58 | |||||||||

CNY | The Chinese yuan maintained a firm footing within its managed trading band, with USD/CNY fluctuating narrowly and leaning slightly lower before stabilising. Daily midpoint settings from the People’s Bank of China signalled a preference for stability, even as underlying flows pointed to appreciation pressure from export receipts and post–Lunar New Year corporate conversions. However, policy fine-tuning late in the period, including the removal of the 20% risk reserve requirement on forward FX contracts, suggested authorities were keen to prevent overly rapid gains, prompting brief softness in offshore yuan markets. Broader US dollar resilience toward the end of the week also limited further upside for CNY. Overall volatility remained contained, reflecting the managed nature of the regime. In the coming sessions, attention will centre on PBoC fixing guidance, trade data trends, offshore positioning dynamics and the direction of US macro developments, all of which shape the yuan’s near-term trajectory. Expected weekly trading range: 4.95 - 5.11 | |||||||||

INR | The Indian rupee navigated a volatile backdrop with a slight weakening bias, as USD/INR hovered near the ₹91 mark amid rising external pressures. Escalating Middle East tensions lifted crude oil prices, intensifying headwinds for the oil-import-dependent economy and dampening sentiment toward the currency. At the same time, safe-haven demand for the US dollar limited any sustained rupee recovery. The Reserve Bank of India was seen actively smoothing volatility around key psychological levels, helping prevent disorderly moves despite intermittent capital outflows from local equity and bond markets. Corporate flows and non-deliverable forward activity kept trading ranges relatively contained, even as underlying pressure persisted. In the period ahead, rupee direction will remain sensitive to oil price dynamics, RBI intervention signals, US macro momentum and shifts in foreign investment flows into Indian assets. Expected weekly trading range: 65.75 - 67.75 | |||||||||

AUD | The Australian dollar carved out modest gains, with AUD/USD holding a constructive bias and edging higher by the close despite intermittent pullbacks. Support stemmed from the Reserve Bank of Australia’s relatively firm policy stance, which has helped maintain favourable yield differentials and sustained interest in carry positioning. While early-week trade uncertainty and geopolitical unease tempered risk appetite, a softer tone in the US dollar later in the period allowed the Aussie to regain traction. Commodity-linked fundamentals also lent background support, reinforcing the currency’s resilience near the 0.70 handle. That said, lingering US inflation concerns and cautious global sentiment capped the scope for a broader rally. Looking ahead, domestic CPI and growth data, RBA communication and shifts in US macro expectations will remain central to the Australian dollar’s near-term trajectory. Expected weekly trading range: 0.96 - 0.98 | |||||||||

NZD | The New Zealand dollar struggled to build sustained upside momentum, with NZD/USD confined below the 0.6000 threshold and ending the period marginally softer. Early stability driven by tentative risk-on sentiment faded as renewed US dollar firmness and lingering trade uncertainty capped rallies. The Reserve Bank of New Zealand’s steady and accommodative policy stance offered little fresh incentive for buyers, particularly as expectations for near-term tightening remained subdued relative to other major economies. As a high-beta, risk-linked currency, the kiwi was also sensitive to shifts in global sentiment, which turned more cautious mid-week and limited appreciation attempts. Despite intermittent dip-buying near support levels, the broader tone remained one of consolidation. In the sessions ahead, focus will rest on RBNZ communication, US economic releases and evolving risk appetite, alongside commodity and export flow trends that shape medium-term currency dynamics. Expected weekly trading range: 0.81 - 0.83 | |||||||||

MXN | The Mexican peso held within a narrow corridor, with USD/MXN showing a slight upward tilt as broader dollar firmness trimmed earlier stability. Price action lacked strong directional conviction, reflecting a balance between supportive domestic fundamentals and external pressure from a steadier greenback. Elevated inflation and Banxico’s relatively high policy rate continued to anchor the peso’s yield appeal, helping cushion downside moves even as global FX flows favoured the US dollar at times. Solid late-2025 growth momentum also reinforced underlying resilience, though not enough to generate a decisive rally. Risk sentiment across emerging markets remained mixed, keeping volatility contained and preventing a sharp break in either direction. In the week ahead, focus will remain on US macro signals and Federal Reserve expectations, Banxico guidance and inflation trends, oil price dynamics and broader capital flows into emerging markets. Expected weekly trading range: 12.44 - 12.82 | |||||||||

Key Economic Indicators Impacting the Loonie

Economic calendar risks intensify in the first week of March, with USD/CAD likely to trade in a more reactive tone as US labour and growth data dominate the latter half of the week. Early sessions will be shaped by manufacturing PMIs on both sides of the border, including Canada’s S&P Global Manufacturing PMI and the US ISM Manufacturing print. Stronger US factory data relative to Canada could tilt USD/CAD higher by reinforcing economic divergence, while any upside surprise in Canadian activity may lend modest support to the loonie. Eurozone inflation and PMI releases may influence broader risk sentiment, but North American data will remain the primary driver for the pair.

Volatility risks rise sharply into Friday as US Nonfarm Payrolls, unemployment, participation and average hourly earnings headline the week. A robust US jobs report combined with firm wage growth would likely revive US dollar demand and push USD/CAD upward, especially if retail sales earlier in the day also beat expectations. Conversely, signs of cooling employment momentum or softer wage inflation could weigh on Treasury yields and pressure the greenback. Canada’s Ivey PMI will add a domestic layer late in the session, but unless it delivers a material surprise, USD/CAD direction will largely hinge on whether US data reinforces or challenges the prevailing Fed policy outlook.

| Key Economic Data Events This Week | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GBP | Mar 1, 2026 | Housing Prices | |||||||||||||||||||||||

| EUR | Mar 1, 2026 | Eurozone Manufacturing PMI | |||||||||||||||||||||||

| GBP | Mar 1, 2026 | Bank of England Consumer Credit | |||||||||||||||||||||||

| CAD | Mar 2, 2026 | S&P Global Manufacturing PMI | |||||||||||||||||||||||

| USD | Mar 2, 2026 | ISM Manufacturing PMI | |||||||||||||||||||||||

| EUR | Mar 3, 2026 | Inflation Rate | |||||||||||||||||||||||

| EUR | Mar 3, 2026 | Eurozone Services + Composite PMI | |||||||||||||||||||||||

| GBP | Mar 3, 2026 | S&P Global Composite + Services PMI | |||||||||||||||||||||||

| EUR | Mar 4, 2026 | Unemployment Rate | |||||||||||||||||||||||

| EUR | Mar 4, 2026 | Producer Prices Index | |||||||||||||||||||||||

| USD | Mar 4, 2026 | ADP Nonfarm Employment Change | |||||||||||||||||||||||

| USD | Mar 4, 2026 | ISM Services PMI | |||||||||||||||||||||||

| GBP | Mar 4, 2026 | S&P Global Construction PMI | |||||||||||||||||||||||

| EUR | Mar 5, 2026 | Retail Sales | |||||||||||||||||||||||

| USD | Mar 5, 2026 | Initial Jobless Claims | |||||||||||||||||||||||

| USD | Mar 5, 2026 | Import + Export Price Index | |||||||||||||||||||||||

| USD | Mar 5, 2026 | Nonfarm Productivity | |||||||||||||||||||||||

| GBP | Mar 5, 2026 | Halifax House Price Index | |||||||||||||||||||||||

| EUR | Mar 6, 2026 | GDP Growth Rate | |||||||||||||||||||||||

| USD | Mar 6, 2026 | Retail Sales | |||||||||||||||||||||||

| USD | Mar 6, 2026 | Nonfarm Payrolls | |||||||||||||||||||||||

| USD | Mar 6, 2026 | Unemployment Rate | |||||||||||||||||||||||

| USD | Mar 6, 2026 | Participation Rate | |||||||||||||||||||||||

| USD | Mar 6, 2026 | Average Hourly Earnings | |||||||||||||||||||||||

| CAD | Mar 6, 2026 | Ivey PMI | |||||||||||||||||||||||

| USD | Mar 6, 2026 | Business Inventories | |||||||||||||||||||||||

Currency market updates

Track key currency movements and plan your transfers with confidence.

Switch to MTFX for better exchange rates, lower fees, and real savings on foreign currency transfers.

We make sending money simple

How to send money with MTFX

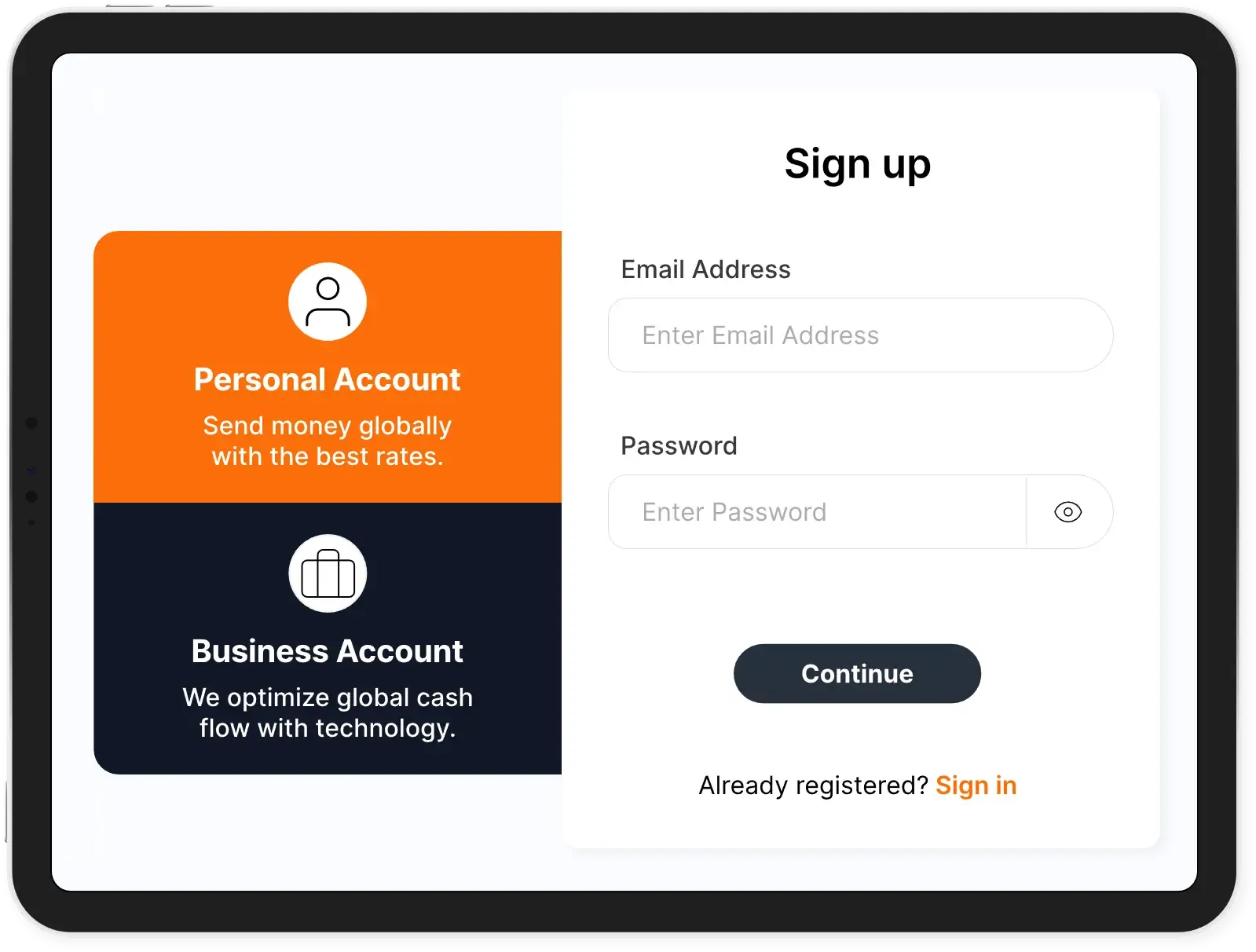

Open your personal or business account and start saving on international money transfers.

- 1Sign up for free

Create your account in less than five minutes—no setup fees or hidden charges.

- 2Get a real-time exchange rate

Instantly access competitive exchange rates for your transfer amount and destination.

- 3Enter recipient information

Provide your recipient’s banking details to ensure fast and secure delivery of funds.

- 4Confirm and send your transfer

Review the details, complete your transaction, and track your transfer every step of the way.

How we deliver reliable weekly FX insights?

MTFX’s weekly FX analysis is built on a foundation of data-driven research and decades of market experience. Each report draws from a combination of live exchange rate feeds, central bank publications, economic calendars, and insights from top financial institutions. Our analysts interpret these inputs to provide clear, actionable commentary.

We focus on transparency and consistency, so you always know where the information comes from and why it matters. Whether you're tracking USD/CAD or broader market shifts, MTFX offers reliable weekly FX updates you can use to plan smarter currency transfers and protect your bottom line.

How we deliver reliable weekly FX insights?

MTFX’s weekly FX analysis is built on a foundation of data-driven research and decades of market experience. Each report draws from a combination of live exchange rate feeds, central bank publications, economic calendars, and insights from top financial institutions. Our analysts interpret these inputs to provide clear, actionable commentary.

We focus on transparency and consistency, so you always know where the information comes from and why it matters. Whether you're tracking USD/CAD or broader market shifts, MTFX offers reliable weekly FX updates you can use to plan smarter currency transfers and protect your bottom line.

What can cause fluctuations in weekly exchange rates?

Weekly exchange rates can shift due to a range of economic and geopolitical factors. Central bank interest rate decisions, inflation reports, employment data, and political developments all play a role in driving currency values.

For example, if oil prices surge or the Bank of Canada issues a surprise policy change, it could significantly impact the Canadian dollar this week. Since FX markets are highly reactive, rates can change multiple times throughout the week. While our FX weekly outlook provides expert insights and trends, contact MTFX directly for real-time, bank-beating exchange rates tailored to your needs.

With MTFX, you can send money to over 190 countries in 50+ currencies—quickly, securely and at competitive rates.