Weekly Currency Update: Canadian Dollar Forecast This Week

Gain clarity with the Canadian dollar forecast this week, including insights into the foreign exchange market and the impact of exchange rate fluctuations, as part of your weekly currency update. Backed by in-depth market research, economic data, and expert commentary, our analysis equips individuals and businesses with the insights they need to manage currency risk, stay updated on market trends, seize timely opportunities, and maximize the value when sending money abroad.

Weekly Currency Performance Table

Currency | Closing | Weekly | Monthly | Yearly |

|---|---|---|---|---|

| USD / CAD | 1.37 | -0.25% | -1.92% | -4.67% |

| EUR / CAD | 1.62 | 0.24% | -0.14% | 9.60% |

| GBP / CAD | 1.86 | -0.76% | -0.50% | 4.81% |

| CAD / JPY | 115.22 | 0.91% | 1.15% | 8.13% |

| CAD / CHF | 0.57 | -0.53% | -1.60% | -10.92% |

| CAD / CNY | 5.07 | 0.17% | 1.42% | -0.31% |

| CAD / INR | 66.24 | -0.59% | 2.27% | 8.57% |

| AUD / CAD | 0.96 | 0.93% | 3.12% | 6.80% |

| NZD / CAD | 0.82 | 0.04% | 2.96% | 1.68% |

| CAD / MXN | 12.62 | -0.60% | -2.20% | -12.08% |

| FX Market This Week | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

USD | The US dollar ended the week modestly firmer, with the dollar index edging higher overall after peaking mid-week before trimming some gains into Friday’s close, still remaining elevated versus last week’s lows. Support for the greenback came from a combination of cautious Fed expectations and renewed safe-haven demand, particularly as markets reacted to President Trump’s nomination of Kevin Warsh as the next Fed chair, reinforcing the view that policy easing may remain gradual. Risk-off moves across global equities also encouraged defensive flows into the dollar, while mixed US macro signals kept gains contained, with weaker labour data prompting caution even as consumer sentiment later improved. Although broader reports continue to highlight seasonal and longer-term headwinds for the USD, the week’s rebound reflected short-term resilience. Attention now turns to next week’s US CPI and key jobs data, alongside Fed commentary and global risk sentiment, which will be central in determining whether the dollar can extend its stability. | |||||||||

CAD | The Canadian dollar stabilized over the week after an early dip, with USD/CAD trading in a relatively narrow range and ending Friday slightly lower, signalling a mild net strengthening in CAD versus the US dollar. The loonie came under pressure at the start of the week as a sharp sell-off in oil and precious metals weighed on the commodity-linked loonie, while mid-week USD strength, supported in part by market positioning and the nomination of Kevin Warsh as Fed chair, added further headwinds. Sentiment improved later in the week as Bank of Canada Governor Tiff Macklem pushed back against expectations for additional rate cuts, helping to limit downside. Domestic labour data also delivered mixed but supportive signals, with Canada losing 24,800 jobs in January but the unemployment rate falling to a 16-month low of 6.5% alongside gains in full-time employment, allowing CAD to recoup much of its weekly softness into Friday as risk conditions steadied. Expected weekly trading range: 1.35 - 1.39 | |||||||||

EUR | The euro softened modestly against the majors over the week, with EUR/USD drifting from the mid-1.18s on Monday toward the low 1.1777 area by Friday, reflecting a mild net decline within a relatively tight range. The move remained subdued as the European Central Bank held rates unchanged, keeping its deposit rate at 2% and signalling confidence in the region’s economic resilience even as inflation dipped below target. Eurozone inflation eased to around 1.7% in January, reinforcing expectations for a steady policy stance and limiting scope for euro strength. ECB commentary continued to point toward stability rather than an imminent shift toward hikes or cuts, leaving the single currency range-bound, while broader fluctuations in US dollar sentiment helped keep volatility contained and the week’s trend gently tilted lower into the close. Expected weekly trading range: 1.60 - 1.64 | |||||||||

GBP | Sterling weakened against the major peers over the week, with GBP/USD slipping from early levels near 1.37 to around 1.358 by Friday’s close, marking a modest but clear downward drift. The pound was broadly steady at the start of the week as markets anticipated an unchanged Bank of England decision, but sentiment shifted sharply after the BoE held rates at 3.75% in a narrow 5–4 vote and signalled that rate cuts could follow if inflation continues to ease. That dovish tilt prompted a reassessment of near-term policy expectations and weighed on sterling mid-week, while broader risk-off conditions and renewed US dollar support added further pressure. Political and economic uncertainty in the UK also lingered in the background, reinforcing a softer tone for GBP as the week closed. Expected weekly trading range: 1.83 - 1.89 | |||||||||

JPY | The Japanese yen came under steady pressure this week, with USD/JPY climbing from the mid-155s toward 157.2 by Friday’s close, signalling a clear weakening in JPY against the US dollar. The move was largely driven by broad dollar strength, supported by safe-haven demand and firmer US sentiment, which kept the greenback outperforming lower-yielding currencies. Yen sentiment was further weighed down by political uncertainty ahead of Japan’s lower house election, with markets positioned for a ruling-party outcome that could reinforce fiscal stimulus expectations and limit support for the currency. While some mid-week commentary pointed to signs of fatigue at higher levels, the overall price action remained firmly tilted upward, leaving the yen on the defensive as the week ended on a low for JPY. Expected weekly trading range: 113.49 - 116.95 | |||||||||

CHF | The Swiss franc held onto mild strength this week, with USD/CHF drifting lower through mid-week as safe-haven demand supported CHF before ticking modestly higher into Friday, signalling a small pullback from its strongest levels. Early gains were underpinned by cautious global risk sentiment, which continued to favour traditional defensive currencies, while commentary from the Swiss National Bank reinforced the franc’s supportive backdrop, with policymakers highlighting a challenging environment of near-zero inflation and rates held at 0%. Broader USD resilience later in the week, driven by renewed risk aversion and safe-haven flows into the greenback, limited further franc appreciation and contributed to the slight rebound in USD/CHF by the close. With the franc still trading near multi-year highs in the wider market context, the week reflected continued demand for safety, even as late-week dollar strength capped upside. Expected weekly trading range: 0.56 - 0.58 | |||||||||

CNY | The Chinese yuan strengthened modestly against its peers this week, with USD/CNY drifting lower from Monday toward Friday’s close, reflecting a gentle but steady appreciation in the currency. Market commentary noted the yuan was extending its longest weekly winning streak in more than a decade, supported by firm export demand and seasonal conversion flows ahead of the Lunar New Year, as Chinese firms increased USD-to-yuan receipts conversions. The People’s Bank of China also maintained a measured approach through its daily midpoint settings, helping to smooth volatility while allowing gradual strength rather than sharp swings. Broader softness in the US dollar during parts of the week provided an additional tailwind, leaving the yuan slightly firmer overall as the week ended. Expected weekly trading range: 4.99 - 5.15 | |||||||||

INR | The Indian rupee delivered a strong performance this week, with USD/INR falling sharply on Monday before a modest retracement into Friday as some dollar demand returned. The move marked the rupee’s best weekly showing in more than three years, driven largely by a surge in optimism after reports of a US–India trade agreement, which triggered the biggest one-day INR gain since 2018 and boosted broader sentiment toward Indian assets. Supportive conditions were reinforced by the Reserve Bank of India holding its policy rate steady at 5.25%, maintaining a neutral stance amid stable inflation and growth expectations. Late in the week, importer dollar demand and corporate hedging activity helped cap further gains, but the rupee still finished the period stronger on net, reflecting a decisive improvement in positioning and confidence through the week. Expected weekly trading range: 65.25 - 67.23 | |||||||||

AUD | The Australian dollar ended the week modestly stronger against the US dollar, with AUD/USD rising from around 0.695 on Monday to just above 0.70 by Friday, despite some mid-week volatility and a brief dip toward Thursday’s lows. The currency found early support after the Reserve Bank of Australia raised rates by 25 basis points to 3.85%, its first hike in two years, reinforcing a more hawkish policy outlook and prompting markets to price in the possibility of further tightening. Risk sentiment, however, remained a key swing factor, with global equity weakness briefly weighing on the AUD later in the week before the currency regained footing as the US dollar softened and broader conditions stabilized into the close. Expected weekly trading range: 0.94 - 0.97 | |||||||||

NZD | The New Zealand dollar finished the week modestly stronger, with NZD/USD rising back above 0.60 by Friday after a mid-week pullback, ending slightly firmer on net despite notable swings through the period. The kiwi gained early, supported by broader antipodean strength and a softer stretch in USD positioning, before weakening toward Thursday’s lows as profit-taking and renewed dollar demand weighed on risk-sensitive currencies. Underlying sentiment toward the NZD was helped by an economic backdrop that reduced expectations of near-term rate cuts, providing some stability despite volatility. By the close, improved global risk conditions and a modest retracement in the US dollar allowed the kiwi to recover, leaving the week characterised by a mid-week high, a sharp dip, and a late rebound into Friday’s finish. Expected weekly trading range: 0.81 - 0.83 | |||||||||

MXN | The Mexican peso ended the week modestly stronger, with USD/MXN falling from early levels near 17.53 toward a mid-week low around 17.24 before retracing slightly into Friday’s close near 17.36. The peso found support during the middle of the week as global risk appetite improved, helping drive renewed demand for higher-yielding emerging market currencies. Additional underpinning came from the Bank of Mexico holding its policy rate at 7.0% after an extended easing cycle, signalling a more cautious stance amid lingering inflation risks. Expectations for firmer January inflation also contributed to a steadier peso tone, although periodic US dollar strength later in the week limited further gains and prompted a mild pullback into the close, leaving MXN still slightly firmer overall for the period. Expected weekly trading range: 12.43 - 12.81 | |||||||||

Key Economic Indicators Impacting the Loonie

The economic calendar for the week beginning February 9 delivers a focused mix of sentiment, labour, and growth indicators that will help shape mid-February market expectations. Monday opens with Eurozone investor confidence, an early gauge of risk appetite, followed later by the UK retail sales monitor, offering insight into consumer spending momentum. Tuesday shifts attention to the US, with a dense block of releases including ADP employment, retail sales, the employment cost index, and import and export price data, alongside business inventories, providing a layered view of labour conditions, consumer demand, and inflation pressures. Eurozone current account data adds an external balance dimension to the European outlook.

Midweek focus turns to North American labour and housing signals on Wednesday, with Canadian building permits paired with US nonfarm payrolls and the unemployment rate, while the UK house price balance offers an additional read on domestic demand conditions. Thursday broadens the growth narrative with a full UK data suite covering GDP, industrial production, business investment, and trade balance, alongside US jobless claims and existing home sales. The week concludes on Friday with key Eurozone releases on GDP and trade balance, before US inflation data takes centre stage, rounding out a high-impact stretch of events that will refine expectations for economic momentum and central bank policy direction heading deeper into February.

| Key Economic Data Events This Week | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR | Feb 8, 2026 | Investor Confidence | ||||||||||||||||||

| GBP | Feb 9, 2026 | Retail Sales Monitor | ||||||||||||||||||

| EUR | Feb 9, 2026 | Current Account | ||||||||||||||||||

| USD | Feb 10, 2026 | ADP Employment Change Weekly | ||||||||||||||||||

| USD | Feb 10, 2026 | Retail Sales | ||||||||||||||||||

| USD | Feb 10, 2026 | Employment Cost Index | ||||||||||||||||||

| USD | Feb 10, 2026 | Import + Export Prices Index | ||||||||||||||||||

| USD | Feb 10, 2026 | Business Inventories | ||||||||||||||||||

| CAD | Feb 11, 2026 | Building Permits | ||||||||||||||||||

| USD | Feb 11, 2026 | Non Farm Payrolls | ||||||||||||||||||

| USD | Feb 11, 2026 | Unemployment Rate | ||||||||||||||||||

| GBP | Feb 11, 2026 | House Price Balance | ||||||||||||||||||

| GBP | Feb 11, 2026 | GDP Growth Rate | ||||||||||||||||||

| GBP | Feb 11, 2026 | Industrial Production | ||||||||||||||||||

| GBP | Feb 11, 2026 | Business Investment | ||||||||||||||||||

| GBP | Feb 11, 2026 | Trade Balance | ||||||||||||||||||

| USD | Feb 12, 2026 | Initial Jobless Claims | ||||||||||||||||||

| USD | Feb 12, 2026 | Existing Home Sales | ||||||||||||||||||

| EUR | Feb 13, 2026 | GDP | ||||||||||||||||||

| EUR | Feb 13, 2026 | Trade Balance | ||||||||||||||||||

| USD | Feb 13, 2026 | Inflation Rate | ||||||||||||||||||

Currency market updates

Track key currency movements and plan your transfers with confidence.

Switch to MTFX for better exchange rates, lower fees, and real savings on foreign currency transfers.

We make sending money simple

How to send money with MTFX

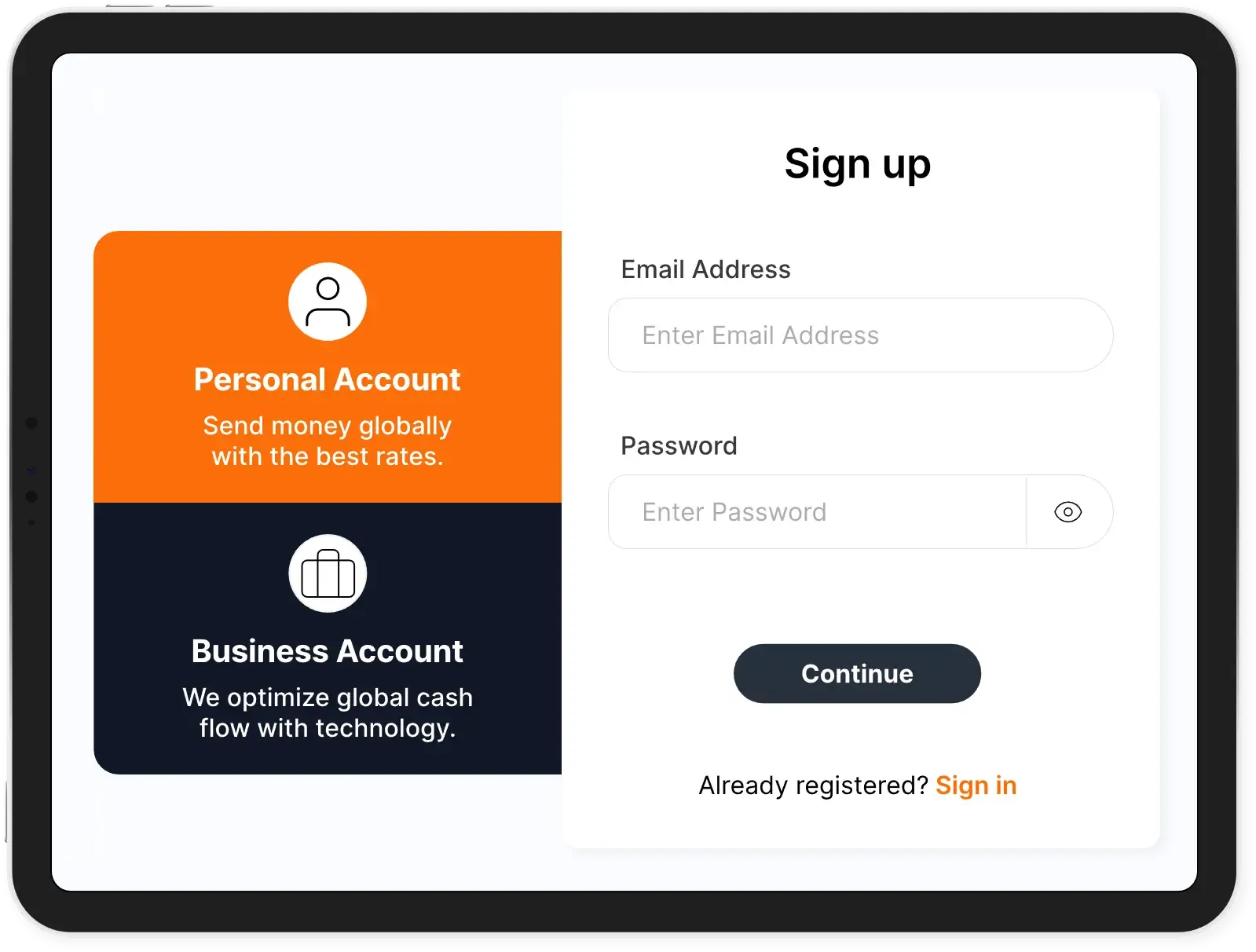

Open your personal or business account and start saving on international money transfers.

- 1Sign up for free

Create your account in less than five minutes—no setup fees or hidden charges.

- 2Get a real-time exchange rate

Instantly access competitive exchange rates for your transfer amount and destination.

- 3Enter recipient information

Provide your recipient’s banking details to ensure fast and secure delivery of funds.

- 4Confirm and send your transfer

Review the details, complete your transaction, and track your transfer every step of the way.

How we deliver reliable weekly FX insights?

MTFX’s weekly FX analysis is built on a foundation of data-driven research and decades of market experience. Each report draws from a combination of live exchange rate feeds, central bank publications, economic calendars, and insights from top financial institutions. Our analysts interpret these inputs to provide clear, actionable commentary.

We focus on transparency and consistency, so you always know where the information comes from and why it matters. Whether you're tracking USD/CAD or broader market shifts, MTFX offers reliable weekly FX updates you can use to plan smarter currency transfers and protect your bottom line.

How we deliver reliable weekly FX insights?

MTFX’s weekly FX analysis is built on a foundation of data-driven research and decades of market experience. Each report draws from a combination of live exchange rate feeds, central bank publications, economic calendars, and insights from top financial institutions. Our analysts interpret these inputs to provide clear, actionable commentary.

We focus on transparency and consistency, so you always know where the information comes from and why it matters. Whether you're tracking USD/CAD or broader market shifts, MTFX offers reliable weekly FX updates you can use to plan smarter currency transfers and protect your bottom line.

What can cause fluctuations in weekly exchange rates?

Weekly exchange rates can shift due to a range of economic and geopolitical factors. Central bank interest rate decisions, inflation reports, employment data, and political developments all play a role in driving currency values.

For example, if oil prices surge or the Bank of Canada issues a surprise policy change, it could significantly impact the Canadian dollar this week. Since FX markets are highly reactive, rates can change multiple times throughout the week. While our FX weekly outlook provides expert insights and trends, contact MTFX directly for real-time, bank-beating exchange rates tailored to your needs.

With MTFX, you can send money to over 190 countries in 50+ currencies—quickly, securely and at competitive rates.