Canadian Dollar Forecast - February 2026

Access the latest CAD forecast along with major economic event listings to understand emerging trends. Track projected currency movements, exchange rate variations, and key market drivers, including fluctuations in the US dollar, to make better-timed international transfers or hedging decisions.

Loonie heads into February supported by firmer oil, steady BoC policy

As February 2026 begins, the Canadian dollar remains underpinned by firm energy prices and a broadly steady monetary-policy backdrop. Through January, USD/CAD trended lower, easing from the high-1.38 area toward the mid-1.35s as rising crude prices and a softer US dollar supported the loonie. The Bank of Canada kept its policy rate unchanged at 2.25%, reinforcing a cautious yet stable stance while highlighting elevated uncertainty stemming from US trade policy developments and ongoing geopolitical risks.

South of the border, the Federal Reserve also left rates unchanged, keeping markets focused on relative policy paths, inflation persistence, and shifts in global risk sentiment. Meanwhile, crude oil’s push to multi-month highs late in January continued to provide a supportive backdrop for the commodity-linked Canadian dollar heading into February.

Canadian Dollar Performance

That said, gains were uneven. The loonie lagged against parts of Europe and select emerging-market currencies, where growth differentials and shifting expectations for rate cuts drove cross-currency flows. Overall, January underscored a Canadian dollar that remained well supported but range-constrained, with near-term direction shaped more by global monetary policy signals, energy markets, and risk sentiment than by domestic data alone.

| Currency Pair | Feb 01, 2026 | Weekly Change | Monthly Change | Yearly Change |

|---|---|---|---|---|

| USD / CAD | 1.36 | -0.34% | -0.50% | -5.32% |

| EUR / CAD | 1.61 | -0.58% | 0.63% | 8.49% |

| GBP / CAD | 1.86 | -0.38% | 1.10% | 4.00% |

| CAD / JPY | 113.84 | 0.63% | -0.92% | 5.55% |

| CAD / CHF | 0.57 | -0.19% | -1.98% | -10.29% |

| CAD / CNY | 5.11 | 0.26% | -0.16% | 1.23% |

| CAD / INR | 67.37 | 0.07% | 2.12% | 11.10% |

| AUD / CAD | 0.95 | -0.26% | 2.92% | 5.29% |

| NZD / CAD | 0.82 | 0.07% | 3.46% | 0.92% |

| CAD / MXN | 12.82 | 1.42% | -1.58% | -8.89% |

Canadian Dollar Quarterly Forecast

Against the euro and pound, CAD is projected to remain under mild pressure in the near term before levelling out later in the quarter, reflecting relatively slower growth momentum and evolving rate-cut expectations abroad. By contrast, the loonie is expected to trend firmer versus the yen, Swiss franc, and select emerging-market currencies, supported by carry dynamics, improving risk sentiment, and Canada’s ongoing commodity exposure. Overall, the outlook suggests a resilient but range-driven Canadian dollar, with cross-currency performance increasingly dictated by global growth divergence and policy timing rather than domestic catalysts.

| Currency Pair | Mar 2026 | Jun 2026 | Sep 2026 | Dec 2026 |

|---|---|---|---|---|

| USD / CAD | 1.37 | 1.36 | 1.35 | 1.35 |

| EUR / CAD | 1.64 | 1.63 | 1.62 | 1.62 |

| GBP / CAD | 1.87 | 1.85 | 1.84 | 1.82 |

| CAD / JPY | 113.14 | 114.47 | 115.38 | 116.89 |

| CAD / CHF | 0.57 | 0.58 | 0.59 | 0.59 |

| CAD / CNY | 5.07 | 5.07 | 5.15 | 5.15 |

| CAD / INR | 65.22 | 65.88 | 66.36 | 67.54 |

| AUD / CAD | 0.96 | 0.97 | 0.97 | 0.99 |

| NZD / CAD | 0.78 | 0.79 | 0.80 | 0.80 |

| CAD / MXN | 12.06 | 11.98 | 12.11 | 12.29 |

Key Economic Events This Month

Attention then turns to guidance from Bank of Canada Governor Macklem, alongside critical inflation and housing indicators such as US CPI, Canadian building permits, Canada’s inflation rate, and housing starts. As the month progresses, a dense US data slate, including retail sales, FOMC minutes, durable goods orders, core PCE inflation, and GDP, will be complemented by Canadian trade balance, retail sales, and GDP figures, helping shape Canadian dollar expectations heading into March.

| Currency | Date | Event |

|---|---|---|

| USD | Feb 4, 2026 | ADP Nonfarm Employment Change |

| CAD | Feb 5, 2026 | BoC Gov Macklem Speaks |

| USD | Feb 6, 2026 | Nonfarm Payrolls |

| USD | Feb 6, 2026 | Unemployment Rate |

| CAD | Feb 6, 2026 | Employment Change |

| CAD | Feb 6, 2026 | Unemployment Rate |

| USD | Feb 11, 2026 | Inflation Rate |

| CAD | Feb 11, 2026 | Building Permits |

| CAD | Feb 16, 2026 | Inflation Rate |

| CAD | Feb 16, 2026 | Housing Starts |

| USD | Feb 17, 2026 | Retail Sales |

| USD | Feb 18, 2026 | FOMC Minutes |

| USD | Feb 18, 2026 | Durable Goods Orders |

| CAD | Feb 19, 2026 | Trade Balance |

| CAD | Feb 20, 2026 | Retail Sales |

| USD | Feb 20, 2026 | Core PCE Price Index |

| USD | Feb 20, 2026 | GDP |

| CAD | Feb 27, 2026 | GDP |

Upcoming Central Bank Meetings

| Country | Date | Event |

|---|---|---|

| Europe | Feb 5, 2026 | European Central Bank Interest Rate Decision |

| United Kingdom | Feb 5, 2026 | Bank of England Interest Rate Decision |

| Canada | Mar 18, 2026 | Bank of Canada Interest Rate Decision |

| United States | Mar 18, 2026 | Federal Reserve Interest Rate Decision |

| Japan | Mar 19, 2026 | Bank of Japan Interest Rate Decision |

Currency market updates

Track key currency movements and plan your transfers with confidence.

Switch to MTFX for better exchange rates, lower fees, and real savings on foreign currency transfers.

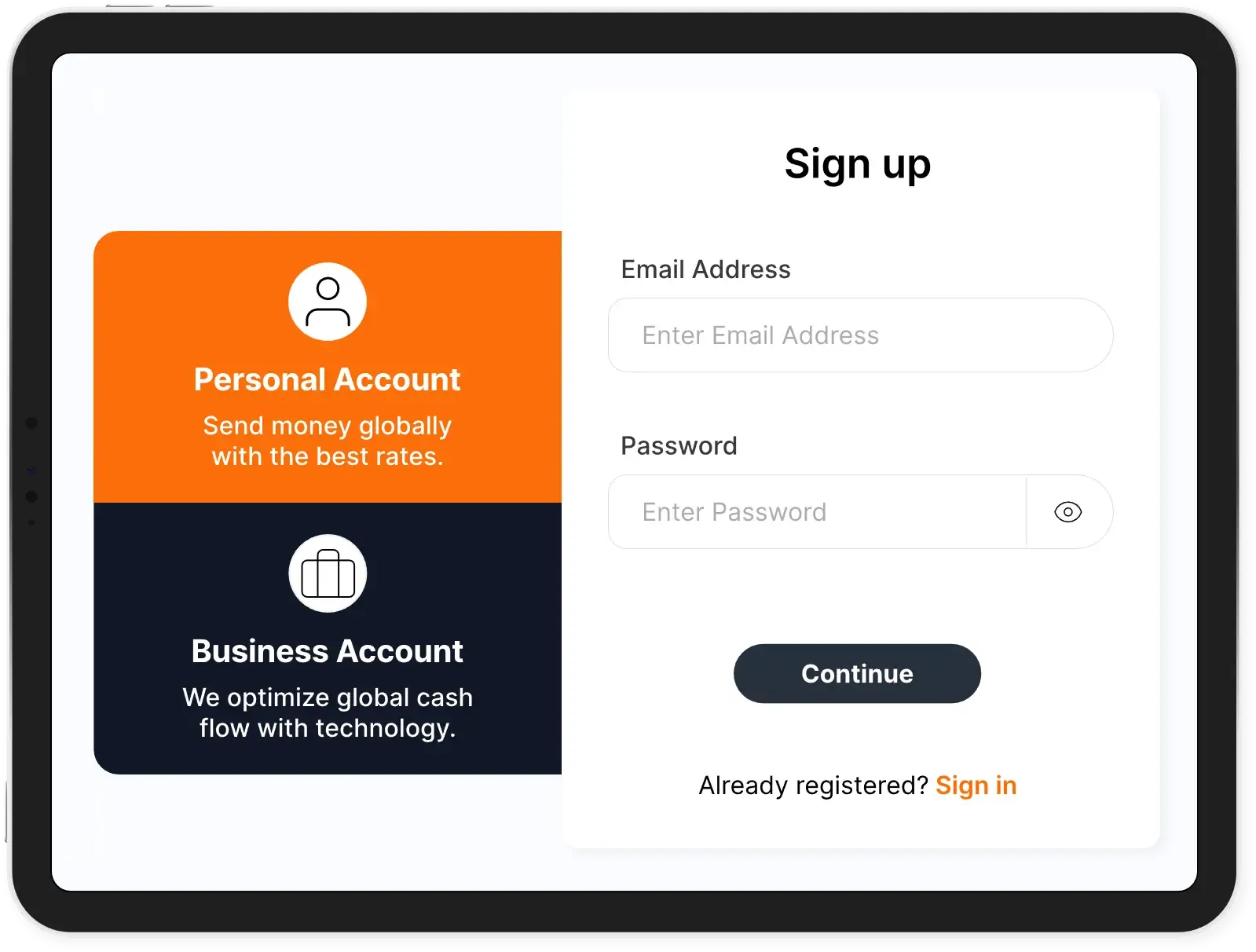

We make sending money simple

How to send money with MTFX

Discover the easiest way to send money online.

- 1Sign up for free

Sign up in less than 5 minutes for your MTFX personal account and get bank-beating rates for sending money abroad.

- 2Get a real-time exchange rate

Enter the amount you want to send and instantly view real-time global currency exchange rates.

- 3Enter recipient information

Fill in your recipient’s banking details or select from your already saved contacts for quick transfers.

- 4Confirm and send your transfer

Review details, confirm the transaction and send money to the desired country without any hassle.

How to read the CAD forecast?

The forecast shows you where the Canadian dollar is expected to head over the next few months, based on key market data and trends. Just pick the currency pair you care about (like CAD to the US dollar), and look across the quarters to see how the rate is projected to change.

If the future exchange rate is higher, it could mean the Canadian dollar is expected to weaken against the US dollar. If it’s lower, the loonie might be gaining strength. The Canadian dollar forecast can help you decide when to exchange, transfer, or hold off, giving you more control over your international payments.

How to read the CAD forecast?

The forecast shows you where the Canadian dollar is expected to head over the next few months, based on key market data and trends. Just pick the currency pair you care about (like CAD to the US dollar), and look across the quarters to see how the rate is projected to change.

If the future exchange rate is higher, it could mean the Canadian dollar is expected to weaken against the US dollar. If it’s lower, the loonie might be gaining strength. The Canadian dollar forecast can help you decide when to exchange, transfer, or hold off, giving you more control over your international payments.

Understanding volatility and risk in FX markets

Foreign exchange markets are highly sensitive to global events, including geopolitical tensions, economic data releases, and central bank decisions, and understanding trends can be crucial for navigating these changes. These factors can trigger sudden shifts in currency values, especially for currencies like the Canadian dollar and the US dollar. As a result, the Canadian dollar forecast can quickly change when new information impacts market sentiment.

For instance, an unexpected interest rate hike, a surprise inflation reading, or political instability can cause the CAD to strengthen or weaken rapidly. That’s why forecasts should be seen as directional insights rather than fixed outcomes; they’re based on current conditions but remain vulnerable to volatility.

With MTFX, you can send money to over 190 countries in 50+ currencies—quickly, securely and at competitive rates.