Explained: What is a SWIFT Code?

In today's interconnected world, financial transactions transcend borders, allowing individuals and businesses to easily transfer money between countries. The global economy depends on secure and efficient systems to facilitate these transactions, whether paying for goods, sending remittances, or managing international B2B payments.

One such vital component is a SWIFT code. This unique identifier plays a key role in ensuring that funds are accurately directed to the intended bank during international transfers. If you've ever needed to send money with a SWIFT code, you've likely noticed how essential it is in simplifying the complexities of cross-border payments. It acts as a global banking "address," ensuring your transaction reaches the right destination without delays or errors.

Understanding the importance of a SWIFT code is crucial for anyone dealing with international banking, whether for personal or business purposes. With this system, financial institutions worldwide can communicate seamlessly, making globalization not just possible but efficient and reliable.

What's a SWIFT code?

A SWIFT code is a globally recognized, unique identifier comprising 8 to 11 characters that helps pinpoint a specific bank or financial organization. SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication, a powerful messaging network that facilitates secure communication between financial institutions across different countries. This system ensures that international payments are processed accurately, efficiently, and securely.

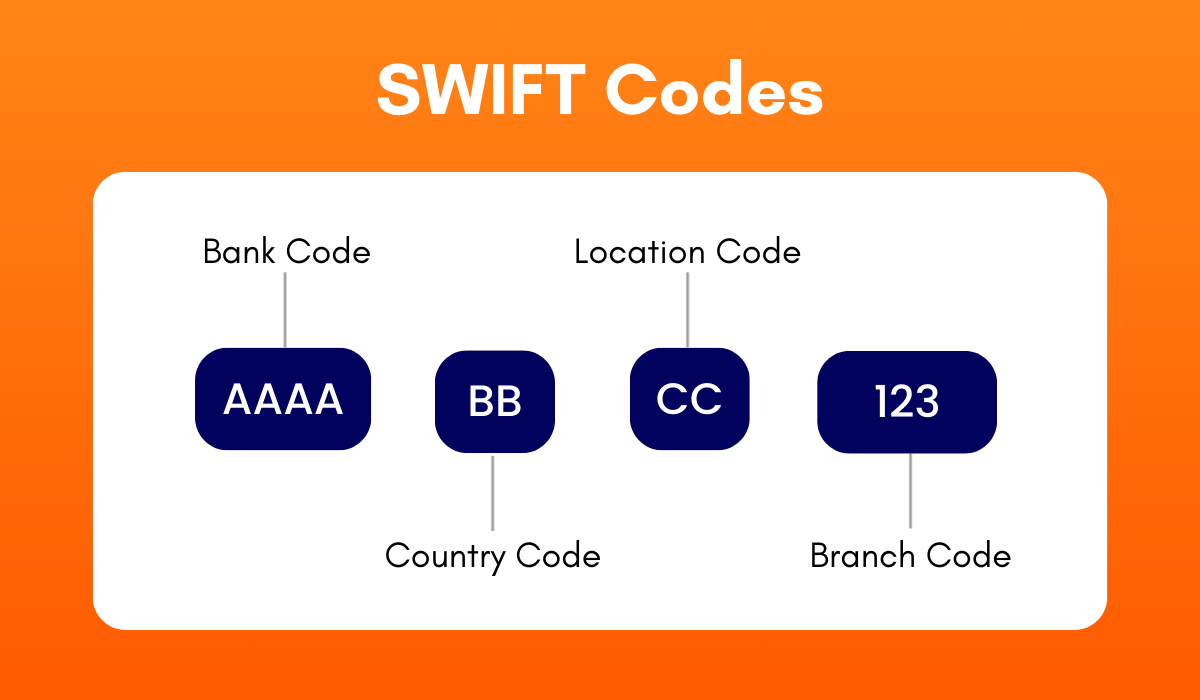

The structure of a SWIFT code (sometimes referred to as a SWIFT identifier code or BIC, short for Bank Identifier Code) is comprised of:

- Bank code (4 characters) – Identifies the bank.

- Country code (2 characters) – Specifies the country of the bank.

- Location code (2 characters) – Indicates the city or region.

- Branch code (3 characters, optional) – Identifies a particular branch, such as a security bank SWIFT code for a specific branch of Security Bank.

How does SWIFT code work?

When you initiate an overseas money transfer, your financial institution uses the SWIFT network to send a payment instruction to the recipient's bank. The SWIFT identifier code ensures the message is routed correctly, containing details like the recipient's bank and account information and the amount being transferred.

Here’s a simplified process:

- Your bank sends a secure message via the SWIFT network using the recipient’s BIC and SWIFT code.

- The message is transmitted to the recipient's financial institution through the SWIFT network.

- Once received, the recipient’s bank processes the instruction, clearing and crediting the funds to the intended account.

It’s important to note that the SWIFT network doesn’t physically move money or maintain accounts. Instead, it acts as a secure messaging platform that transmits payment orders and instructions between banks. Using a SWIFT code is essential for ensuring that funds are sent to the correct financial institution. Whether you're paying a vendor, sending money to loved ones, or completing a business transaction, this unique code eliminates the risks of misdirected payments or delays.

Why are SWIFT codes important?

SWIFT codes play a crucial role in the global financial system by enabling seamless, secure, and efficient communication between banks. They ensure that international payments are directed accurately, minimizing errors and delays. Whether you’re sending money from Canada to another country or receiving funds from abroad, a SWIFT bank identifier code is essential for completing the transaction.

Ensuring accuracy in global financial transactions

When transferring money internationally, precision is critical to avoid costly errors. A SWIFT bank identifier code guarantees that the payment is directed to the intended financial institution. This eliminates the risk of funds being sent to the wrong bank, which could cause delays or result in lost payments. In Canada, major banks rely on SWIFT codes to facilitate accurate transactions with their global counterparts, ensuring customer satisfaction and trust.

Enhancing security and efficiency in cross-border payments

The SWIFT network is globally recognized for its robust security measures. It employs advanced encryption protocols to safeguard sensitive financial data during transmission. This level of security is critical for cross-border payments, protecting against unauthorized access and fraud. Furthermore, SWIFT streamlines international banking by automating communication between banks, reducing manual intervention and the potential for human errors. Canadians also benefit from SWIFT transfer times, which generally range from 1–5 business days, depending on the banks involved and the recipient’s location.

Facilitating communication among banks

SWIFT codes are the backbone of communication in the global banking system. They allow financial institutions in different countries to exchange transaction details in a standardized and secure format. For example, when initiating a SWIFT international transfer from Canada to Europe or Asia, the SWIFT network ensures that payment instructions are transmitted with precision and clarity. This efficient communication reduces delays, prevents misunderstandings, and ensures a smooth transfer of funds between banks worldwide.

Promoting transparency in transactions

SWIFT codes contribute to transparency in global transactions by providing a clear record of payment flows. This traceability benefits individuals and businesses, allowing them to track payments at every stage. For Canadians, this added visibility ensures confidence in their international transfers and fosters trust between senders and recipients.

Supporting international trade and business

In addition to individual transactions, SWIFT codes are essential for businesses engaging in global trade. They enable companies to settle cross-border invoices quickly and securely, enhancing relationships with international suppliers and clients. For Canadian businesses operating globally, SWIFT codes streamline operations and contribute to efficient cash flow management, which is critical for success in today's competitive markets.

Difference between the SWIFT code and other banking identifiers

A SWIFT code is a unique identifier for international transactions, ensuring funds are directed to the correct bank and branch. However, other banking identifiers also play key roles in different types of transactions, and understanding the distinctions is important for smooth banking operations.

SWIFT code vs. IBAN

An IBAN (International Bank Account Number) identifies a specific bank account in international transactions, while a BIC and SWIFT code identifies the bank. For example, during an international wire transfer SWIFT process, the SWIFT code ensures the payment reaches the correct bank, while the IBAN ensures the funds are deposited into the right account within that bank.

SWIFT code vs. routing numbers

Routing numbers are primarily used for domestic transactions, especially in countries like Canada and the US, while the SWIFT BIC format is used globally for cross-border payments. Routing numbers are numeric and specific to a region, whereas SWIFT codes have an alphanumeric format like BOFMCAM2XXX and follow a standardized global structure.

SWIFT code vs. sort code

Sort codes are used in countries like the UK to identify banks and branches for domestic payments, but they are not used for international transactions. In contrast, a SWIFT code is essential for global payments, ensuring secure and accurate communication between banks.

In summary, the SWIFT BIC format is the gold standard for international payments, while other identifiers like IBANs, routing numbers, and sort codes cater to specific domestic or account-level purposes. Understanding these differences helps ensure your local or international transactions are processed smoothly and efficiently.

How to find a SWIFT code

You'll need a SWIFT code to identify the recipient's bank when transferring money overseas. The SWIFT identifier code allows banks worldwide to identify each other and process transactions within seconds. Using the correct SWIFT code helps prevent international transfer errors and delays, ensuring your funds are delivered promptly.

You can find a SWIFT code in several ways:

- Check the bank’s website: Many banks list their SWIFT codes on their official websites, often in the "International Transfers" section. You can also find it in the FAQs or customer support area.

- Use an online SWIFT code checker: There are several trusted online tools and databases where you can easily search for SWIFT codes by entering the bank's name, branch, or country.

- Confirm with your beneficiary: You can ask the person you're sending money to for the SWIFT identifier code. They can typically find it on their bank statements or by logging into their online banking account.

When sending a SWIFT payment online, it’s crucial to ensure that the correct SWIFT code is used to avoid potential delays or delivery issues. Always double-check the code before initiating a transfer to ensure it’s accurate.

Simplify your global transactions with MTFX

When sending money globally, MTFX makes it easy and reliable. Whether you're transferring funds to your family, paying for studies abroad, or conducting business across borders, we offer a fast and secure way to manage your international payments. Using a SWIFT code, MTFX ensures that your money reaches the correct bank wherever you send it. The SWIFT bank identifier code allows seamless communication between banks worldwide, ensuring accuracy and safety throughout the transfer process.

With MTFX, you can send money anywhere, anytime, without the stress of dealing with complex procedures. The platform’s user-friendly interface makes it simple to initiate transfers, while its integration with the SWIFT network guarantees that funds are securely routed to the recipient's bank. No matter where you are or what time it is, MTFX gives you the flexibility to handle your global transactions effortlessly. Choose MTFX for bank-beating exchange rates and low transaction fees.

Send money SWIFTLY and securely today

A SWIFT code (or BIC and SWIFT code) ensures accurate and secure international transactions. These codes streamline cross-border payments and facilitate global bank communication by uniquely identifying banks and financial institutions. Whether you're sending money from Canada or making an international payment, understanding how these codes work is crucial for avoiding delays and errors. While other banking identifiers like IBANs, routing numbers, and sort codes are used for domestic transactions, the SWIFT code remains the global standard for international wire transfers. By using the right BIC and SWIFT code, you can be confident that your payments will reach the correct destination safely and efficiently.

Open an account today on MTFX for secure online transfers and get best value for your money with bank-beating exchange rates and low fees.

FAQs

1. What is my bank SWIFT code?

Your bank’s SWIFT code is a unique identifier used for international transactions. You can find it on your bank’s website, bank statements, or by asking a bank representative.

2. What is SWIFT transfer?

A SWIFT transfer is a secure and standardized method used to send money internationally. It uses a SWIFT code or SWIFT bank identifier code to route the transaction to the correct bank.

3. How much does a SWIFT money transfer cost?

The SWIFT money transfer fee varies depending on the financial institution and the countries involved in the transaction. MTFX offers competitive rates and low fees for international transfers.

4. How can I send a SWIFT payment online?

You can send a SWIFT payment online by using platforms like MTFX, which facilitates international transfers using the SWIFT network. Simply enter the recipient's bank details, including their SWIFT code, and proceed with the transfer.

5. What is the BIC and SWIFT code?

The BIC and SWIFT code are the same. BIC stands for Bank Identifier Code, and it is used alongside the SWIFT code to route international payments securely and efficiently.

6. How long does a SWIFT transfer take?

The SWIFT transfer time typically takes between 1 to 5 business days, depending on the banks involved and the countries the transfer is between.

7. What is a SWIFT international transfer?

A SWIFT international transfer is a payment made between banks in different countries using the SWIFT network. This secure network ensures that money is transferred quickly and accurately across borders.

8. Can I send money with SWIFT code?

Yes, you can send money with SWIFT code by entering the recipient’s bank details, including the SWIFT code, on an international payment platform like MTFX. This ensures that your transfer reaches the right bank without issues.

Related Blogs

Stay ahead with fresh perspectives, expert tips, and inspiring stories.

Keep updated

Make informed decisions

Access tools to help you track, manage, and simplify your global payments.

Currency market updates

Track key currency movements and plan your transfers with confidence.

Create an account today

Start today, and let us take the hassle out of overseas transfers.