Do You Need a Routing Number for International Transfers?

Confused about whether you need a routing number for an international transfer? You’re not alone. From SWIFT codes and IBANs to routing numbers for US payments, the rules can get tricky fast. This guide breaks everything down clearly- so you’ll know exactly which details to use, when to use them, and how to avoid costly transfer delays.

Sending money across borders can be complicated, especially when you’re dealing with multiple banking codes like routing numbers, SWIFT codes, and IBANs. A single mistake can cause frustrating delays or even failed transfers. So, do you actually need a routing number for an international transfer? The answer depends on where you’re sending the money and which banking systems are involved.

This guide explains when routing numbers matter, when they don’t, and how to make every international transfer smooth and stress-free.

What is a routing number?

A routing number is a unique numerical code that identifies a specific financial institution within a country’s banking network. It’s primarily used to ensure funds are sent to the correct bank during a transaction. In Canada, this number is part of a broader set of identifiers that also includes the transit and institution numbers. Together, these elements help route payments accurately between Canadian banks for domestic transactions such as direct deposits, bill payments, and wire transfers.

In the United States, routing numbers serve a similar purpose. Each bank is assigned a unique routing number used for ACH (Automated Clearing House) payments and domestic wire transfers. These numbers ensure money moves seamlessly between accounts within the US banking system.

It’s important not to confuse routing numbers with other international banking identifiers. While routing numbers are used for domestic transactions in Canada and the US, international transfers typically rely on SWIFT/BIC codes and IBANs.

If you’re unsure which number to use for a particular transaction, a routing numbers lookup tool can help you quickly find and verify the correct code. This prevents errors, delays, or returned payments when setting up transfers.

When are routing numbers required?

Routing numbers are typically required only for domestic money transfers within Canada or the United States. They serve as unique identifiers that help financial institutions direct funds to the correct destination, ensuring smooth and accurate processing.

Domestic transfers within Canada

In Canada, routing numbers are required for a range of local transactions. This includes sending money between two Canadian banks, setting up direct deposits, and making bill payments or domestic wire transfers. The routing number, combined with the transit and institution numbers, ensures payments reach the right account within the Canadian banking system.

Domestic transfers within the United States

In the US, routing numbers are crucial for ACH transfers and domestic wire payments. If you’re transferring funds between two US-based accounts or setting up recurring payments like payroll deposits, you’ll need to provide the correct routing number to avoid delays or errors.

If you’re unsure which code to use, you can find your routing number on your bank statement, through your online banking portal, or with a trusted routing number search tool. Many people start by asking, “What is my routing number?” when setting up new payments. Verifying it beforehand helps prevent processing issues and ensures your funds reach the recipient without delay.

What details are needed for international money transfers?

When sending money overseas, banks and payment providers require specific information to ensure the funds reach the correct destination quickly and securely. Unlike domestic transactions, international transfers rely on globally recognized banking identifiers rather than routing numbers.

Essential information for international transfers

To complete an international payment, you’ll typically need to provide:

- SWIFT/BIC code – This is the primary global identifier used to recognise the recipient’s bank.

- IBAN – Commonly used in Europe and many other countries, the International Bank Account Number ensures accuracy when crediting funds to a recipient’s account.

- Beneficiary’s full name and address – This confirms the identity of the recipient.

- Beneficiary bank’s name and address – Helps pinpoint the exact branch or financial institution.

- Account number or IBAN – Required to route funds correctly to the recipient’s account.

Routing numbers and international payments

Routing numbers are usually not required for international transfers, except in certain cases, such as sending money to the United States, where both the SWIFT/BIC code and the routing number may be needed. If you’re unsure, it’s a good idea to check your account and routing number before initiating a transfer to ensure the details are accurate.

A common question is “How many digits are in a routing number?” In the US, routing numbers are nine digits long, while in Canada, they typically consist of a five-digit transit number plus a three-digit institution number. Knowing the correct format helps avoid delays or returned payments.

When a routing number may still be needed internationally

Although routing numbers are usually not required for most international money transfers, there are specific exceptions, particularly when sending funds to the United States. In these cases, some banks require both a routing number and a SWIFT code to complete the transfer accurately.

Transfers to the United States

When sending money from Canada to a USD account in the US, a routing number supports ACH and wire transfers within the American banking system. Some US banks use the routing number to receive and route funds domestically after they arrive through international payment networks. This means that, in addition to the SWIFT code identifying the bank internationally, the routing number helps direct the funds to the correct branch or account internally.

Banks that require both a routing number and a SWIFT code

Certain US financial institutions ask for both the routing number and the SWIFT code for intermediary or final settlement. This is especially common with smaller regional banks or credit unions that rely on correspondent banks to receive international wires. The SWIFT code identifies the bank on the global network, while the routing number ensures the funds are properly allocated once they enter the US banking system.

Example: Sending CAD to a USD account in the US

Suppose you’re sending Canadian dollars from Canada to a USD-denominated account at a US bank. In this scenario, you’ll likely need the recipient’s SWIFT code for the international leg of the transfer and their routing number for the domestic settlement within the US. Providing both ensures the transaction moves smoothly from the international network into the US domestic system without delays.

Routing number vs SWIFT vs IBAN

When it comes to transferring money, it’s easy to mix up the different types of banking identifiers. Each serves a specific purpose, and understanding the differences helps ensure your payment reaches the right destination without delays.

A routing number is used mainly within Canada and the United States for domestic transfers. For example, a domestic ACH routing number helps identify financial institutions for local payments and is often required for routing number for business transactions, payroll deposits, and bill payments. On the other hand, SWIFT/BIC codes and IBANs are essential for international transfers, serving as global standards to route funds across borders.

For most international transfers, SWIFT/BIC codes and IBANs are the key identifiers- not routing numbers. Routing numbers are used primarily for domestic transfers within Canada or the US and rarely apply outside these regions, except in specific cases like transfers to the US where both routing and SWIFT details may be required.

Tips for a smooth international transfer

A successful international transfer depends on accuracy, preparation, and using the right banking information. Even a small error in account details can cause delays, extra fees, or returned payments. Here are a few practical tips to help make your next transfer seamless:

1. Double-check recipient details

Before confirming your transfer, always review the recipient’s banking information carefully. Make sure the SWIFT/BIC code or IBAN is entered exactly as provided by the beneficiary. A single incorrect digit can cause processing delays or result in the funds being sent back to the sender.

2. Use the correct routing number for US transfers

When transferring funds to the United States, some banks require both the SWIFT code and the routing number. The SWIFT code identifies the bank internationally, while the routing number directs the payment to the correct branch or account within the US. If you’re unsure which to use, it’s best to find your routing number on your bank statement, online banking, or a verified lookup tool before initiating the transfer.

3. Choose a trusted transfer platform

Using a reliable service such as MTFX can help prevent common errors and reduce transfer costs. The MTFX platform automatically validates banking details, supports international formats like SWIFT and IBAN, and ensures your funds are routed efficiently. It’s a secure and cost-effective way to move money across borders without unnecessary delays.

How MTFX simplifies international transfers

When it comes to sending money across borders, accuracy and efficiency are essential. MTFX is built to simplify international transfers by helping you use the correct banking details, including SWIFT codes, IBANs, and routing numbers when required for US payments. The platform combines accuracy tools, cost savings, and faster processing to make global payments more seamless than traditional banks.

Accurate details every time

One of the most common causes of delays in international transfers is entering incorrect banking details. MTFX’s secure platform is designed to guide you through each step, ensuring every required field is filled in correctly for the destination country. Whether you’re transferring funds to Europe, Asia, or the US, the platform automatically applies the right format for SWIFT, IBAN, or routing numbers. You can also use the MTFX routing number lookup or the built-in search tool to verify details before initiating a transfer.

Lower costs and faster processing

MTFX gives individuals and businesses access to competitive foreign exchange rates and low transfer fees, helping you save compared to traditional banks. Transactions are processed through efficient payment networks to deliver funds quickly across major global corridors, including Canada to the US, Europe, and Asia. By eliminating unnecessary intermediaries and using technology-driven processing, MTFX reduces both the time and cost of sending money internationally- making it a smarter choice for regular payments, business transactions, or one-time transfers abroad.

Real-time tools and secure processing

MTFX provides transparent, real-time tools and security features to support every step of your transfer. Live exchange rate displays help you lock in favourable rates, while automated verification checks ensure accuracy before the payment is sent. With bank-grade encryption and regulated operations, MTFX offers peace of mind while maintaining speed and precision. Whether you’re sending money for personal needs or business purposes, the platform combines advanced technology with practical tools to make your international transfers smooth, secure, and cost-effective.

Get every detail right for a seamless transfer

Understanding the difference between routing numbers, SWIFT codes, and IBANs is essential to making international transfers smooth, accurate, and cost-effective. While routing numbers are typically used for domestic transactions, knowing when they apply internationally, especially for transfers to the US, can help you avoid delays and errors. By using the right banking details and a trusted platform, you can move funds across borders with confidence.

Start your international transfer with MTFX today and enjoy accurate, fast, and affordable global payments.

FAQs

1. What is a routing number?

A routing number is a unique numerical code used to identify financial institutions, mainly in Canada and the US. It helps banks direct funds correctly during domestic transactions, including wire transfers, direct deposits, and bill payments.

2. How can I find my routing number?

You can find your routing number in several ways- by checking your bank statement, logging in to your online banking portal, or using the MTFX routing number lookup tool. This tool makes it easy to locate and verify the correct number before sending a payment.

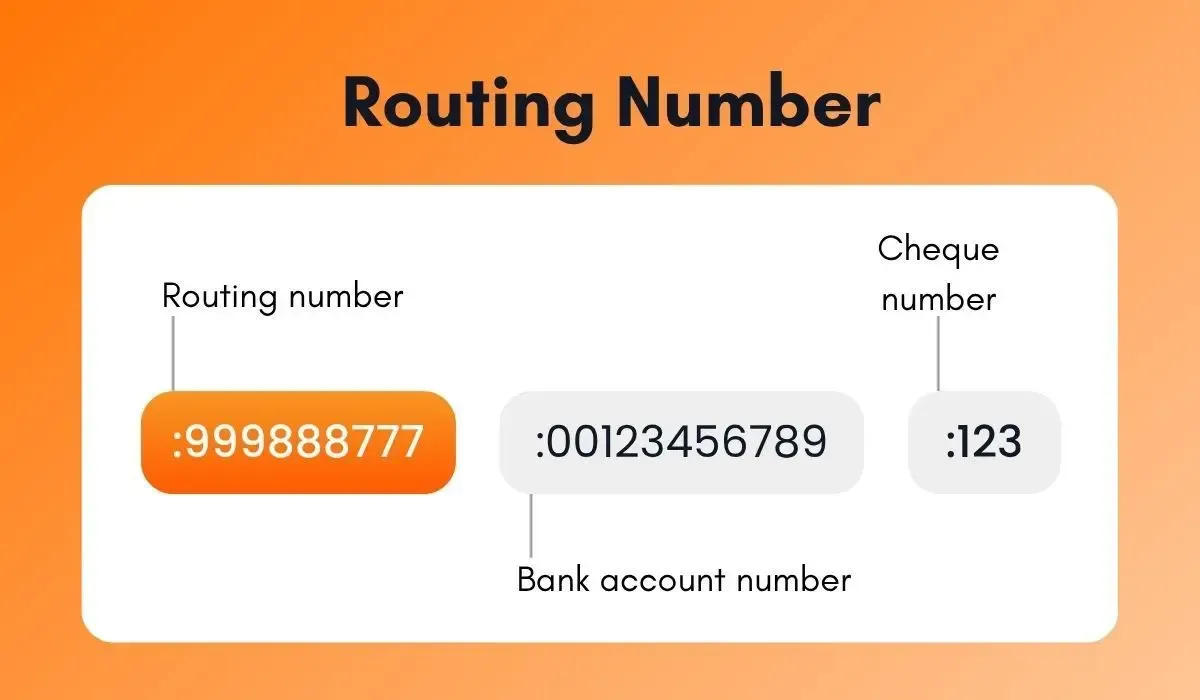

3. How do you find your routing number on a cheque?

If you’re wondering “on a cheque, where is the routing number?”, it’s usually the first nine digits printed at the bottom left corner of a US cheque. In Canada, it appears as part of the MICR code, which includes the transit and institution numbers as well.

4. How many digits are in a routing number?

In the US, a routing number consists of nine digits. In Canada, it’s represented through a five-digit transit number plus a three-digit institution number, often combined to form an eight-digit format for payments.

5. Where can I find a routing number if I don’t have a cheque?

If you don’t have a cheque handy, you can still find your routing number by logging into your online banking account or contacting your bank directly. Alternatively, the MTFX routing number search tool allows you to look it up quickly and accurately.

6. How can I check my account and routing number?

You can check your account and routing number on your bank’s mobile app, paper statement, or cheque. Many banks also list these details under your account settings online.

7. Why is checking the routing number important before a transfer?

Verifying the correct routing number helps ensure that funds are directed to the right bank and account. Entering the wrong number can cause delays, rejected payments, or additional fees.

8. What should I do if I’m unsure about my routing number?

If you’re unsure, don’t guess- always check the routing number first. Log into your bank account or use MTFX’s routing number search tool to confirm the details. This step ensures your international transfer isn’t delayed or returned.

9. Is the routing number used for international transfers?

Routing numbers are generally used for domestic transfers in Canada and the US. For international transfers, SWIFT codes and IBANs are usually required. However, when sending money to the US, you may need to provide both the routing number and SWIFT code to complete the payment.

10. Can I use MTFX to find the correct routing number for a transfer?

Yes. MTFX offers a routing number lookup tool that helps you find and verify the correct number before making a payment. This feature is especially useful when transferring funds to the US, where routing numbers are often required alongside SWIFT codes for accurate processing.

Start your international transfer with MTFX today and enjoy accurate, fast, and affordable global payments.

Related Blogs

Stay ahead with fresh perspectives, expert tips, and inspiring stories.

Keep updated

Make informed decisions

Access tools to help you track, manage, and simplify your global payments.

Currency market updates

Track key currency movements and plan your transfers with confidence.

Create an account today

Start today, and let us take the hassle out of overseas transfers.