Explained: What is an IBAN Code?

Sending money overseas from Canada? IBANs aren’t used here for domestic banking, but many destinations require them. This guide explains how IBANs work, how to find and verify one, and answers what is an IBAN number used for in Canada so your transfer reaches the right account on time and without extra fees.

Sending money overseas often raises questions about banking details — especially around the IBAN. Many Canadians ask what an IBAN number in Canada is and whether it’s required for international transfers. In simple terms, an IBAN helps identify bank accounts in countries that use this system, ensuring payments arrive accurately and without delay. Although IBAN numbers aren’t used in Canada, understanding how they work helps you send money abroad smoothly and avoid transfer errors. Read further to learn how IBANs work and how you can check IBAN for your international transfers.

What is IBAN number?

An International Bank Account Number (IBAN) is a globally recognized code that facilitates secure and efficient international money transfers. Depending on the destination country, you may be required to provide an IBAN if you need to send funds across borders. This raises the question: What exactly is an IBAN code?

Simply put, an IBAN is a unique alphanumeric identifier that helps accurately route payments to the correct bank account. It minimizes errors and speeds up transaction processing by verifying account details before completing a transfer. While IBANs are widely used in Europe and other regions, IBAN is not a standard practice in Canada, where banks rely on SWIFT codes and transit numbers instead. Understanding IBANs ensures smoother international transactions, reducing delays and preventing misdirected payments.

How does an IBAN work?

An International Bank Account Number (IBAN) is a standardized international numbering system that simplifies bank account identification and minimizes errors in cross-border transactions. It ensures that money is transferred accurately by verifying the recipient's banking details before processing a payment. Research indicates that using IBANs reduces transaction errors to less than 0.1% of total payments, making it a globally trusted method for secure and efficient international transfers.

When sending money to a recipient's bank account, it’s not just important to understand the transfer process, but also to gather the recipient’s accurate information. If you’re transferring money to a country that uses IBANs, it’s crucial to have the beneficiary’s IBAN code. Additionally, you’ll need to provide the following details:

- Beneficiary Name

- Beneficiary Address

- Bank Name

- Bank SWIFT Code

- Bank Address

- Reason for Transfer

Your international money transfer provider will use the IBAN code to determine the country of origin and validate your recipient’s account number. This safeguards your funds and ensures that your IBAN transfer arrives quickly and securely.

While IBANs are widely used in Europe, the IBAN system does not exist in Canada, as Canadian banks rely on SWIFT codes and transit numbers for international transactions. However, if you are in Canada and sending money abroad to an IBAN-enabled country, you will still need to provide the recipient's IBAN to ensure your payment is processed smoothly. Without a valid IBAN, your transaction may be delayed or even rejected. To avoid errors, you can use an IBAN calculator to verify the correctness of an IBAN before initiating a transfer.

Understanding how IBANs work is crucial for Canadians making international payments. It helps prevent misdirected funds, reduces processing delays, and ensures seamless transactions worldwide.

What countries use an IBAN system?

The IBAN system is not used globally. According to the IBAN registry published by SWIFT, only 82 out of 195 countries have implemented it. Initially adopted by Eurozone banks, the IBAN became an international standard under ISO 13616:1997. Today, most European countries, including the United Kingdom, France, Italy, and Germany, rely on IBANs for secure, efficient cross-border payments.

Countries like Canada, the United States, and Australia do not use IBANs for domestic banking, instead relying on SWIFT codes and transit numbers. This means if you are sending money to the US, you won't need an IBAN but a SWIFT code. However, Canadians, Americans, and Australians can still send money through IBAN when making payments to regions that require it. To process an IBAN payment method, the recipient’s IBAN must be provided to ensure accurate and timely transactions.

Structure of an IBAN for Canadians

If you live in Canada and need to send money using an IBAN, it’s important to understand how IBANs work. While an IBAN number in Canada isn’t used for domestic transactions, you’ll still need to provide one when sending money to countries that require it.

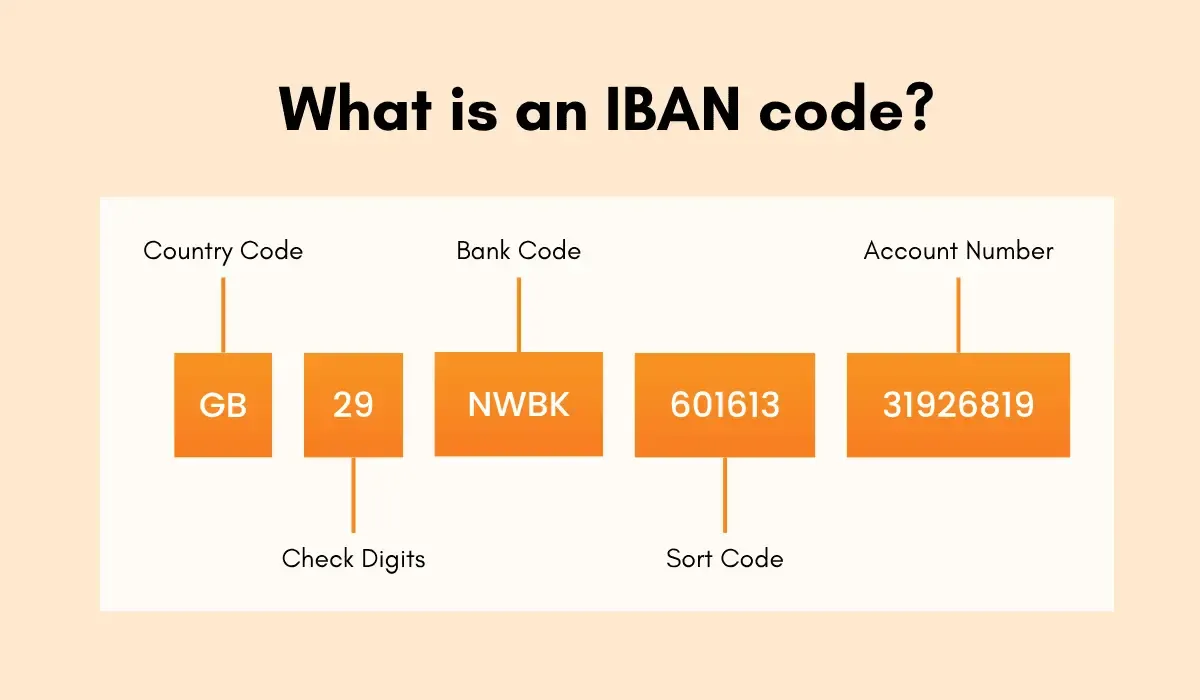

Breakdown of IBAN Components:

- Country Code – The first two letters indicate the recipient’s country (e.g., "FR" for France, "DE" for Germany).

- Check Digits – Two control numbers that help detect errors in the IBAN.

- Bank Identifier – A unique set of characters that identifies the recipient’s bank.

- Account Number – The recipient’s specific bank account number.

For example, if you're sending money to a bank in France, the IBAN might look like this: FR76 30003 03620 00020216907 50

- FR (Country Code: France)

- 76 (Check Digits)

- 30003 03620 (Bank Identifier)

- 00020216907 50 (Account Number)

Before making an international payment, using an international bank account checker to verify the IBAN's validity is wise. This helps ensure your transaction is processed smoothly and reaches the intended recipient without errors or delays.

How does IBAN differ from other banking codes?

When sending money internationally, you’ll often see IBAN, SWIFT, and routing numbers- each plays a different role in identifying where funds should go.

A SWIFT code (or BIC code) is used to identify a specific bank or financial institution in global transactions. It helps direct payments to the correct bank. On the other hand, a routing number is used within Canada and the United States for domestic transfers, identifying the specific bank and branch handling the transaction.

Unlike most countries, Canada does not use IBAN numbers for its banking system. Canadian banks use SWIFT codes for international transfers and routing numbers for local payments. However, when sending money to countries that require an IBAN, you’ll still need to provide the recipient’s IBAN along with their SWIFT code to make sure the transfer reaches the right account.

How to find your IBAN?

If you’re planning to send money abroad, you may be learning about the best methods for international transfers and other key considerations. While exploring your options, make sure to check if you need the recipient’s IBAN to complete the transfer. If you do, here’s the correct way to go about it.

Bank statements and online banking portals

One of the easiest ways to find an IBAN is by checking bank statements or logging into an online banking portal. Many banks display the IBAN on monthly statements, particularly for accounts supporting international transfers. If you’re sending money through an online money transfer platform, ask your recipient to check their online banking dashboard, where the IBAN is often displayed alongside the account number and SWIFT code. Ensuring the correct IBAN is used helps prevent delays and failed transactions, providing a smooth international transfer experience.

Contact the bank for IBAN details

Since IBAN numbers aren’t commonly used in Canada, many people may have trouble finding them on their own. If the recipient can’t locate their IBAN through online banking or account statements, they should contact their bank directly. The bank can provide the correct IBAN based on the destination country’s banking system. Using the correct IBAN format for international transfers is important, so it’s always better to confirm the details with the bank rather than face delays or payment issues later.

Simplify your international transfers with MTFX

When sending money internationally, it's essential to prioritize accuracy, security, and cost-effectiveness. MTFX offers a reliable and efficient platform for Canadians transferring money overseas using IBANs and SWIFT codes, making international transfers seamless. Here are a few advantages of choosing MTFX:

- Competitive exchange rates – Get better rates than banks, saving you money on every transfer.

- Low transfer fees – Enjoy cost-effective international transactions with transparent pricing.

- Fast & secure transactions – Send money quickly and safely to IBAN-supported countries.

- Real-time exchange rate tracking – Lock in the best rates for your transfer.

- Personalized support – Get expert assistance for hassle-free transactions.

- Convenient online platform – Transfer funds anytime, anywhere, with ease.

With MTFX, you can verify your IBAN, confidently convert money from CAD to USD, JPY, or any other major currency, and send money abroad while ensuring secure, accurate, and cost-effective transfers. Start your international payment today!

Got your IBAN? Send money abroad today

An IBAN ensures secure, accurate, and efficient international money transfers. Whether you're sending money from Canada to any country using the IBAN system or an online money transfer platform, ensuring the correct IBAN is provided. Thic can prevent errors, fraud, and unnecessary delays. Understanding how to find, use, and verify IBANs simplifies cross-border transactions, making global payments faster, safer, and more reliable. As a Canadian, always request the recipient's IBAN when sending funds abroad to ensure a smooth transfer process.

Create an account today and start your transaction through a reliable online money transfer platform.

FAQs

1. Does it cost money to use an IBAN?

Using an IBAN may not incur direct fees, but banks or transfer platforms may charge fees for international transactions. Check with your provider to understand costs related to IBAN payments.

2. Is it safe to give out an IBAN number?

Yes, it’s safe to share your IBAN for legitimate transactions. Like an account number, it’s only used to process payments to your account and doesn’t provide access to your funds.

3. How can I verify an IBAN?

Before sending money, use an international bank account checker or an IBAN checker to verify the validity of an IBAN. These tools ensure that you have entered the correct details to avoid transaction errors.

4. How do I transfer money using an IBAN number?

To transfer money using an IBAN number, provide the recipient’s IBAN along with their name, bank’s SWIFT code, and other required details. Ensure the IBAN is accurate to prevent delays or errors in your IBAN payment method.

5. What is the purpose of an IBAN payment method?

By standardizing account identification, the IBAN payment method ensures secure, accurate, and efficient international transfers. It reduces errors, speeds up processing, and provides funds to reach the correct recipient.

6. Can I send money through IBAN without a SWIFT code?

No, for international transfers, you usually need both an IBAN and a SWIFT code. The SWIFT code identifies the recipient’s bank, while the IBAN specifies the account.

7. What are some benefits of using IBANs for international payments?

IBANs simplify cross-border transactions, reduce errors, enhance security, and ensure smooth payment processing. Using an IBAN calculator or similar tools ensures accuracy. Canadians sending money abroad should always request the recipient’s IBAN for a successful transfer.

8. What happens if I use an incorrect IBAN?

If you use an incorrect IBAN, the transaction may be delayed, rejected, or sent to the wrong account. Always verify the IBAN using an international bank account checker or contact your recipient for confirmation before sending money.

Create an account today and start your transaction through a reliable online money transfer platform.

Related Blogs

Stay ahead with fresh perspectives, expert tips, and inspiring stories.

Keep updated

Make informed decisions

Access tools to help you track, manage, and simplify your global payments.

Currency market updates

Track key currency movements and plan your transfers with confidence.

Create an account today

Start today, and let us take the hassle out of overseas transfers.