Best Way to Send Money from Canada to the US – MTFX vs Your Bank

Why choose MTFX over banks for US money transfers?

Save on international transfers with MTFX. Enjoy bank-beating exchange rates, low fees, and fast same or next-day transfers to the US. Skip the delays and high costs of traditional banks. Create your free account today and send money securely, affordably, and with complete peace of mind.

When you're looking to send money from Canada to the US, the natural impulse might be to default to your Canadian bank. But is that the most cost-effective way to send money from Canada to the US? To be honest, no, as there are better alternatives. Enter MTFX, a fintech-driven foreign exchange provider that offers Canadians a compelling alternative to the high fees and sluggish processing times of traditional banks to transfer money overseas.

In this post, we will break down how MTFX compares to banks in terms of fees, exchange rates, transfer speeds, and overall user experience. Whether you're buying property in the US, paying tuition, funding a business venture, or simply supporting family across the border, this comparison will help you choose smarter and save on foreign currency transaction fees as well as currency conversion charges.

Are banks really the easiest way to send money from Canada to the US?

You may think that banks are the easiest way to send money from Canada to the US, but that convenience comes at a price, even if it’s there. When you initiate a CAD to USD transfer through a major Canadian bank, you usually pay a markup of 2% to 4% above the real exchange rate, known as the mid-market rate. On a $20,000 transfer, that could mean an extra $400 to $800 just in currency conversion costs.

Then there are the additional bank wire transfer fees, often ranging from $30 to $50 per transaction. Some banks even charge incoming fees on the US side. Add it all up, and you're spending significantly more than you bargained for. What's more, banks typically do not offer rate guarantees or transparent rate previews. The final exchange rate is often revealed only at the time of execution, after the transfer is locked in.

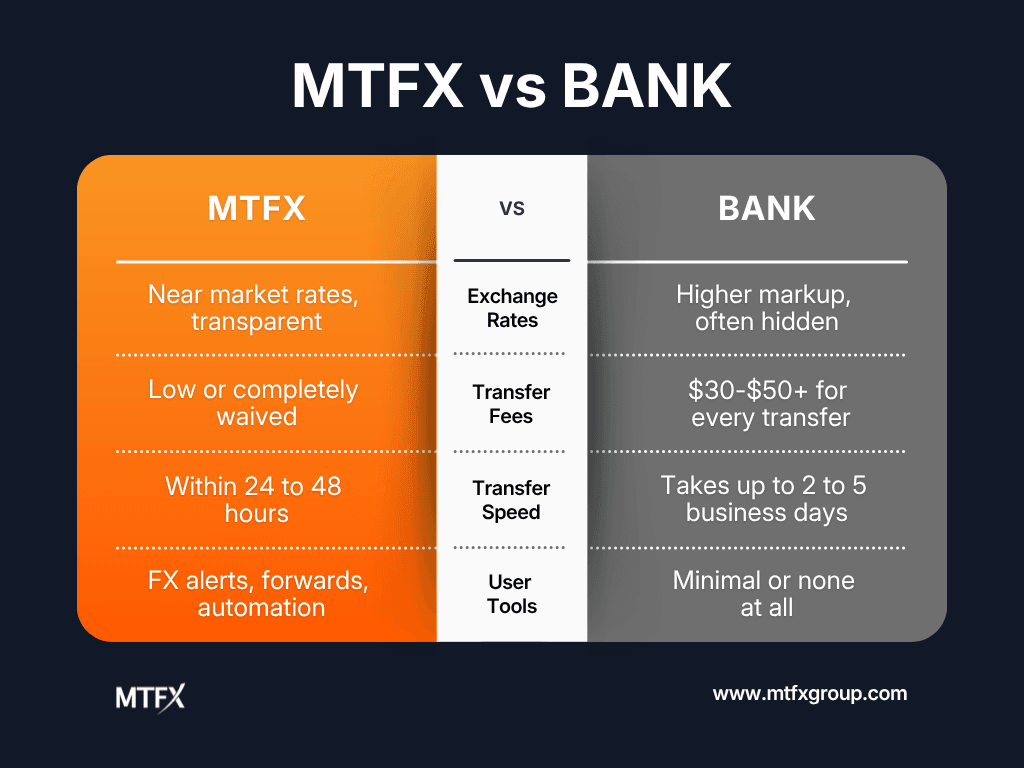

Cost comparison - MTFX vs banks

How to avoid high bank fees when sending money to the US from Canada?

MTFX is built to challenge the traditional banking norms. With bank-beating exchange rates that are much closer to the mid-market rate—often within 0.3% to 0.6%—MTFX ensures that more of your money reaches its destination. On that same $20,000 CAD to USD transfer, MTFX could save you upwards of $300 just on the rate difference alone.

When you are looking to transfer money to the USA, MTFX offers low-fee transactions, with service charges that are often significantly lower than what banks impose. Some transfers even qualify for fee waivers depending on the amount and method used. The platform also offers CAD to USD rate alerts, allowing you to plan your CAD to USD transfers when rates are most favourable, making MTFX the cheapest method to transfer money internationally.

Speed is another area where MTFX excels. While banks may take 2-5 business days to complete a cross-border wire transfer to the US, MTFX can often process transfers within 24 to 48 hours. Faster transactions mean more control, especially when you're timing payments to meet deadlines like tuition due dates or real estate closings.

Experience faster transfers with fewer fees. Get started now.

A user-centric online experience for sending money to the US

MTFX operates entirely online, offering a streamlined platform to send money from Canada to the US, where users can lock in USD exchange rates, set up beneficiaries, and track transactions in real time. This contrasts sharply with the cumbersome process of scheduling in-branch appointments or navigating clunky banking apps.

Whether you're transferring funds from your desktop at work or your mobile device while travelling, MTFX ensures full visibility and ease. Multi-device compatibility, secure logins, and real-time notifications not only make the user experience secure but also the easiest way to send money abroad.

For frequent users or businesses making regular payments to the US, MTFX also offers automated solutions, batch payments, and customized FX risk management strategies. These features are simply not part of the standard bank offering, making MTFX ideal for growing enterprises and high-frequency individual users alike.

Plan ahead when you send money from Canada to the US

MTFX offers a range of FX tools that allow you to monitor exchange rates and lock in your desired CAD to USD rate when you send money to the US. Our tools include:

- Live rate calculator: Know exactly how much you'll send and receive before confirming.

- Rate alerts: Get notified when your preferred exchange rate hits.

- Forward contracts: Lock in a favourable rate for future transfers.

- Recurring transfers: Automate payments for tuition, rent, or business invoices.

- Batch payments: Send to multiple recipients in one go—ideal for businesses.

Monitor, plan, and control your currency exchange strategy. Set a CAD to USD rate alert today.

Secure online platform for cross-border money transfers

You might wonder: Is MTFX secure? Absolutely. MTFX is fully regulated by FINTRAC (Financial Transactions and Reports Analysis Centre of Canada) and other governing bodies. Funds are held in segregated accounts, ensuring your money is safe and traceable at every step. Our digital-first approach does not compromise security but enhances efficiency through automation and real-time oversight.

MTFX also adheres to international compliance standards and implements rigorous Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. That means your transactions are fast and cost-effective, and fully compliant with Canadian and US regulations.

Case study: Property purchase in the US

Consider a Canadian snowbird purchasing a $400,000 home in Florida. Using a bank, they might lose up to 4% on the exchange—that’s $16,000 in hidden FX costs. With MTFX, the same transaction could cost less than $2,000 in FX margin, depending on the prevailing rates. Add in the faster transaction times, and you’re looking at tangible savings and peace of mind during a high-stakes financial move.

Planning a major purchase in the US? Get your personalized FX quote.

Sending money to the US? See how MTFX beats your bank

The verdict: Is MTFX better than banks for sending money to the US?

If you value convenience, lower costs, and speed when sending money to the US, MTFX is the clear winner. Banks still have their place for in-person service and all-in-one financial management, but for cross-border transfers to the US, they simply can't compete with the specialization and pricing transparency that MTFX delivers.

MTFX is purpose-built to provide you with the best way to send money from Canada to the US, offering better rates, faster delivery, and a digital-first experience that banks struggle to match. Whether you're a snowbird maintaining a Florida property, a parent paying US college fees, or a small business expanding south of the border, you owe it to yourself to explore smarter alternatives. With MTFX, you get more than a transaction—you get a financial partner.

Ready to make a smarter move?

Start your low-fee money transfer to the US with MTFX today and see the difference a better exchange rate makes.

Open your MTFX account now and take the first step toward smarter international transfers.

FAQs

1. Are banks still the best way to send money from Canada to the US?

The best way to send money from Canada to the US is through a trusted fintech provider like MTFX. Unlike traditional banks, MTFX offers bank-beating exchange rates, lower fees, and fast processing, making it a cost-effective international payment solution.

2. How can I transfer money to the USA with low fees?

To transfer money to the USA affordably, consider using MTFX over banks. While bank wire transfer fees can reach $30–$50, MTFX keeps costs low with fees starting as low as $15 and often waived for larger transfers.

3. What are the foreign currency transaction fees when sending CAD to USD?

Foreign currency transaction fees vary widely by provider. Banks may include hidden currency conversion charges or international transaction fees, while MTFX provides transparent, real-time currency exchange rates with lower markups on CAD to USD transfers.

4. Why is MTFX the easiest way to send money from Canada to the US?

MTFX is the easiest way to send money from Canada to the US due to its fully online platform, 24/7 access, and automated tools. You can lock in rates, set up recurring payments, and manage all your pay and transfer needs in one place.

5. How does MTFX compare to banks on exchange rates and fees?

MTFX typically offers exchange rates 2–4% better than banks, along with lower international transaction fees. This makes it the cheapest method to transfer money internationally, helping you save more on every CAD to USD transfer.

6. Can I check real-time currency exchange rates before I send money?

Yes, MTFX allows you to view real-time currency exchange rates before confirming your transfer. This level of rate transparency is rare with banks, which often apply hidden markups when you send money to the US.

7. What are the bank wire transfer fees for sending money overseas?

Bank wire transfer fees for sending money overseas typically range between $30 and $50 or more. These costs add up over time, whereas MTFX provides a cost-effective international payment solution with competitive flat fees or waived charges.

8. Are there additional US fees when using banks to transfer money?

Yes, banks often apply additional US correspondent bank fees and international transaction fees. With MTFX, these extra costs are rare due to its direct global network, making it a smarter choice for CAD to USD transfers.

9. How do Canadian savings interest rates impact currency transfers?

Canadian savings interest rates can influence exchange rate decisions, especially if you're timing a large CAD to USD transfer. With MTFX, you can hold funds, monitor market conditions, and choose the best time to transfer money to the USA.

10. What is the cheapest method to transfer money internationally for recurring payments?

The cheapest method for recurring international payments is using a provider like MTFX. Its automation tools, low fees, and access to bank-beating exchange rates help reduce currency conversion charges and improve overall cost-efficiency.

Related Blogs

Stay ahead with fresh perspectives, expert tips, and inspiring stories.

Keep updated

Make informed decisions

Access tools to help you track, manage, and simplify your global payments.

Currency market updates

Track key currency movements and plan your transfers with confidence.

Create an account today

Start today, and let us take the hassle out of overseas transfers.