IBAN number: Find, check or calculate your IBAN

Easily locate or validate your International Bank Account Number for fast, secure global transfers. Built for privacy and precision - MTFX never stores, sees, or shares the information you enter.

Check an IBAN

Type it in here and we’ll tell you if it’s the right format.

We don't store or share your IBAN information. Your privacy is our priority.

Validate your IBAN. Send money with confidence.

Sending money with MTFX helps you save time and avoid costly errors.

How to find your IBAN number

To ensure smooth and error-free transactions, it’s essential to use the correct IBAN for international money transfers. Entering the wrong IBAN can result in delayed payments, additional fees, or funds being sent to the wrong account.

You can typically locate your IBAN by logging into your online banking portal or reviewing a recent bank statement. You can also use the IBAN validation tools available on this site to help confirm the structure.

Keep in mind: just because an IBAN is formatted correctly doesn’t mean it’s valid or linked to the intended account. Always confirm the IBAN with your recipient or financial institution before sending or receiving international payments.

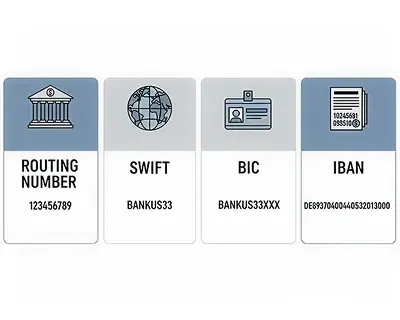

What is the difference between IBAN, SWIFT codes, and routing numbers?

Understanding the difference between IBAN and SWIFT code is essential when sending or receiving funds across borders. Each plays a distinct role in international banking, and knowing which one to use ensures faster, more accurate transfers.

An IBAN number (International Bank Account Number) identifies the individual account involved in an international payment. Commonly used across Europe and increasingly adopted worldwide, IBANs help route payments to the correct recipient account.

A SWIFT code, also known as a BIC (Bank Identifier Code), identifies the bank or financial institution itself. It’s required for processing international wire transfers and is used globally.

For domestic transfers within the United States, routing numbers are used instead of IBANs. A routing number is unique to US banks and is required to process domestic ACH payments and wire transfers. These numbers are used only for transactions within the US and cannot be used for international payments.

What is the difference between IBAN, SWIFT codes, and routing numbers?

Understanding the difference between IBAN and SWIFT code is essential when sending or receiving funds across borders. Each plays a distinct role in international banking, and knowing which one to use ensures faster, more accurate transfers.

An IBAN number (International Bank Account Number) identifies the individual account involved in an international payment. Commonly used across Europe and increasingly adopted worldwide, IBANs help route payments to the correct recipient account.

A SWIFT code, also known as a BIC (Bank Identifier Code), identifies the bank or financial institution itself. It’s required for processing international wire transfers and is used globally.

For domestic transfers within the United States, routing numbers are used instead of IBANs. A routing number is unique to US banks and is required to process domestic ACH payments and wire transfers. These numbers are used only for transactions within the US and cannot be used for international payments.

Sign up today and send payments on time, every time.

Enjoy better exchange rates, lower fees, and seamless global transfers to over 190 countries with MTFX.