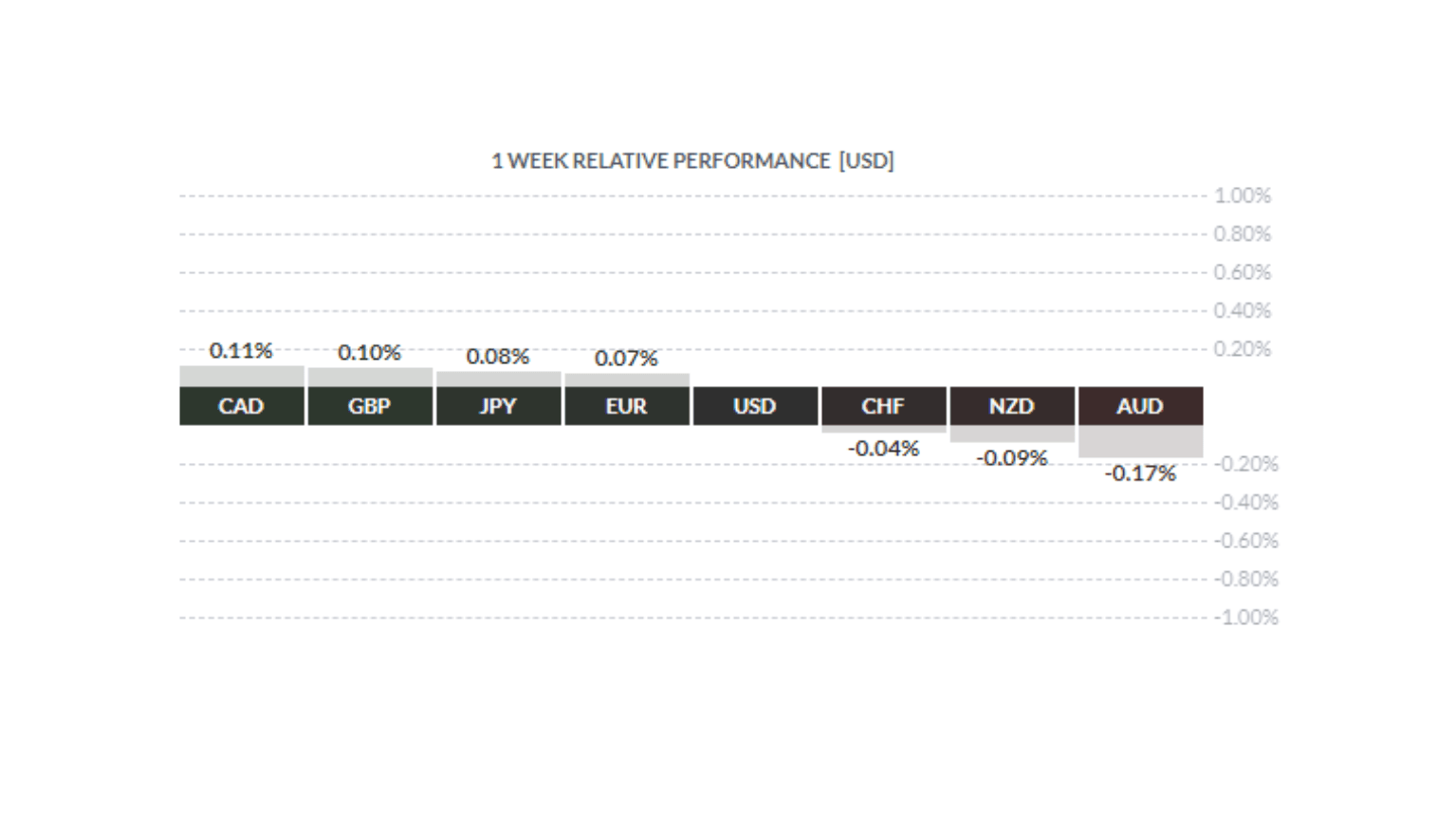

The CAD Managed a Respectable Gain Against the USD

- In spite of market volatility and increased banking sector anxiety, the CAD managed a respectable gain against the USD last week. In comparison to a fair value estimate, the CAD continues to appear cheap. Even while the correlations between the equity markets and the performance of the CAD have loosened recently, they still have some impact on the loonie's valuation. A solid gain on the week now looks likely for US stocks after the main indices dropped to the lowest since Jan earlier last week.

Choppy Range Trade Remains the Main Theme

- Investor apathy towards the CAD may be fueled by the absence of a distinct narrative driving the currency. This suggests for more choppy range trade in the CAD in the short run as spot tracks the general USD tone and the overall market risk backdrop. We are, however, getting close to the conclusion of the CAD's seasonal soft patch, which could suggest that as we enter Q2, a more convincing, CAD-positive story will start to develop. Our model predicts that the USD/CAD will trade in a wide range this week, between 1.3610 and 1.3920.

The Week Ahead

- This week, Canada only has a few announcements, including the Feb CPI on Tuesday and the Jan Retail Sales on Friday. The CPI print for this week is the final print before the policy decision on April 12. The hurdle for higher rates in Canada remains high, made even higher by the recent volatility in bank stock prices, so it is unlikely that the February statistics would have an immediate impact on policymakers. Yet, persistently sticky prices could cast doubt on the durability of the Bank's policy hold. Data reports indicate that the Canadian economy is coping reasonably well in the early months of 2023; yet, tight labor markets, rapid wage growth, and persistent inflation may possibly push the Bank to resume tightening. On Wednesday, a summary of the discussions leading up to the March 8th policy decision will be made public. Also, there aren't many American data releases. Highlights include the FOMC decision on Wednesday and Chairman Powell's press conference; the market anticipates a 25bps raise.

USD/CAD Trading Range

- USD/CAD’s technical picture is mixed; we look for firm resistance at 1.3850/60 while key support remains around 1.3650/60. A break under the mid-1.36 area should see spot edge back to the low-1.35 area.

Let us watch the market for you

Currency market are always moving. Set an alert so you never miss your desired.

Sign up to receive the latest market news from our experts.

FAQs

Who can use the MTFX payment service?

Why should I use MTFX and not my own bank?

How do customers send funds to MTFX?

How long does it take MTFX to transfer funds?

Copyright © 2024 MTFX Group